Projects

Wheeler River Project

Wheeler River

As we continue to advance this exciting project we will post the latest maps and photos. Click icons to view.

Project Highlights

PROJECT DESCRIPTION & LOCATION

Wheeler River is the largest undeveloped uranium project in the eastern portion of the Athabasca Basin region in northern Saskatchewan, Canada. The project hosts two high-grade uranium deposits: Phoenix and Gryphon.

The project is situated in close proximity to important regional infrastructure, including the Provincial electrical transmission grid and an all-season Provincial highway.

PHOENIX FEASIBILITY STUDY AND GRYPHON UPDATED PRE-FEASIBILITY STUDY

On June 26, 2023, Denison announced the results of (i) the Feasibility Study completed for In-Situ Recovery (“ISR”) mining of the high-grade Phoenix uranium deposit (“Phoenix FS”) and (ii) a cost update to the 2018 Pre-Feasibility Study (“2018 PFS”) for conventional underground mining of the basement-hosted Gryphon uranium deposit (“Gryphon Update”).

More Information

For more information regarding the Phoenix FS and Gryphon Update, see:

Location

The property is located along the eastern edge of the Athabasca Basin in northern Saskatchewan, Canada and is located approximately 35 kilometres northeast of the Key Lake mill and 35 kilometres southwest of the McArthur River uranium mine. The property is well located with respect to all-weather roads and the provincial power grid. Vehicle access to the property is by the provincial highway system to the Key Lake mill then by the ore haul road between the Key Lake and McArthur River operations to the eastern part of the property.

Ownership

The project is a joint venture between Denison (90%) and JCU (Canada) Exploration Company Ltd. (10%), with Denison as operator. Effective August 3, 2021, Denison acquired 50% of JCU.

Phoenix FS Highlights:

- Base case pre-tax Net Present Value (“NPV”) (8%) of $2.34 billion (100% ownership-basis) is a 150% increase in the base-case pre-tax NPV8% for Phoenix from the 2018 PFS.

- Very robust base-case pre-tax Internal Rate of Return (“IRR”) of 105.9%.

- Base-case after-tax NPV8% of $1.56 billion (100% basis) and IRR of 90.0% – with Denison’s effective 95% interest in the project equating to a base-case after-tax NPV8% of $1.48 billion.

- Base-case pre-tax and after-tax payback period of 10 months – equating to a reduction of 11 months for the pre-tax payback period from the 2018 PFS.

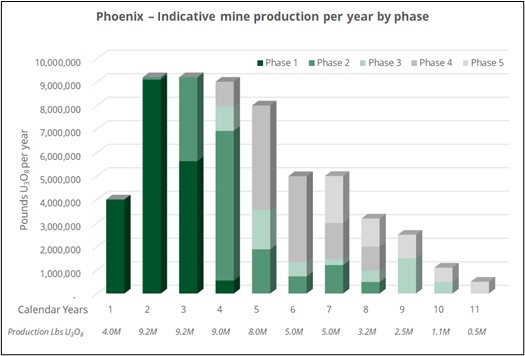

- Production profile has been optimized, based on ISR mine planning efforts evaluating production potential for individual well patterns – resulting in an increase to the planned rate of production by approximately 43% during the first five years of operations.

- Estimated pre-production capital costs of under $420 million (100% basis), yielding an impressive after-tax NPV to initial capital cost ratio in excess of 3.7 to 1.

- Robust economics easily absorb cost-inflation and design changes impacting both operating and capital costs, confirming Phoenix’s position with estimated cash operating and all-in costs expected to be amongst the lowest-cost uranium mines in the world.

- Phoenix FS plans are aligned and costed to meet or exceed environmental criteria expected to be required by the ongoing regulatory approval process.

- Updated mineral resource estimate, reflecting results of 70 drill holes completed in support of ISR de-risking and resource delineation activities, has upgraded 30.9 million pounds U3O8 into Measured mineral resources, and increased the average grade of the Zone A high-grade domain, which is now estimated to contain 56.3 million pounds U3O8 in Measured and Indicated mineral resources, at an average grade of 46.0% U3O8.

- Upgraded 3.4 million pounds U3O8 into Proven mineral reserves, representing the equivalent of 85% of production planned during the first calendar year of operations.

Completion of Phoenix ISR De-Risking:

- The Phoenix FS reflects independent third-party validation of the selection of the ISR mining method for Phoenix, and builds on the findings from a comprehensive and rigorous multi-year technical de-risking process highlighted by the highly successful completion of the leaching and neutralization phases of the Phoenix Feasibility Field Test (“FFT”) in late 2022.

- Through the technical de-risking process, Denison has acquired extensive deposit-specific data and developed a robust ISR mine planning model that involved evaluation of the production potential for individual well patterns.

- With technical de-risking of the project substantially complete, front-end engineering design (“FEED”) efforts to support the advancement of the planned Phoenix operation are already significantly progressed and the Company is on track to transition into detailed design efforts, consistent with the Company’s Outlook for 2023, before the end of the year.

Gryphon Update Highlights:

- Scope of Gryphon Update was targeted at the review and update of capital and operating costs – mining and processing plans remaining largely unchanged from the 2018 PFS aside from minor scheduling and construction sequencing optimizations.

- Base case pre-tax NPV (8%) of $1.43 billion (100% basis), is a 148% increase in the base-case pre-tax NPV8% for Gryphon from the 2018 PFS.

- Strong base-case pre-tax IRR of 41.4%.

- Base-case after-tax NPV8% of $864.2 million (100% basis) and IRR of 37.6% – with Denison’s effective 95% interest in the project equating to a base-case after-tax NPV8% of $821.0 million.

- Base-case pre-tax payback period of 20 months, and base-case after-tax payback period of 22 months – equating to a reduction of 17 months for the pre-tax payback period from the 2018 PFS.

- Project remains to be positioned amongst the lowest-cost uranium mines in the world and provides Denison with an additional source of low-cost potential production to deploy significant free cash flows expected from Phoenix.

Phoenix ISR Feasibility Study

The Phoenix FS was completed by Wood Canada Limited (“Wood”), WSP USA Environment and Infrastructure Inc. (“WSP”), SRK Consulting (Canada) Inc. (“SRK”), and Newmans Geotechnique Inc. (“Newmans”). The study confirms robust economics and the technical viability of an ISR uranium mining operation with low initial capital costs and a high rate of return.

The Phoenix FS reflects several design changes and the results of a rigorous technical de-risking program completed by Denison over the last 4.5 years following the publication of the 2018 PFS, which was highlighted by the then-novel selection of the ISR mining method for Phoenix.

With the benefit of extensive metallurgical and field testing of all key elements of the proposed ISR mining operation, and current cost estimates reflecting recent inflationary pressures, the Phoenix FS is expected to provide Denison with an excellent basis to advance engineering designs in support of a future final investment decision (“FID”).

| Table 1 – Summary of Key Phoenix Operation Parameters (100% Basis) | |

| Mine life | 10 years |

| Proven & Probable reserves(1) | 56.7 million lbs U3O8(220,900 tonnes at 11.6% U3O8) |

| First 5 years of reserves(2) | 41.9 million lbs U3O8(Average 8.4 million lbs U3O8 / year) |

| Remaining years of reserves | 14.8 million lbs U3O8(Average 3.0 million lbs U3O8 / year) |

| Initial capital costs(3) | $419.4 million |

| Average cash operating costs | $8.51 (USD$6.28) per lb U3O8 |

| All-in cost(4) | $21.73 (USD$16.04) per lb U3O8 |

- See Table 5 below for additional information regarding Proven & Probable reserves.

- The first five years is determined by reference to the 60 month period that commences at the start of operations, which occurs half way through calendar year 1, and ends half way through calendar year 6. See below for details.

- Initial capital costs exclude $67.4 million in estimated pre-construction expenditures expected to be incurred pre-FID.

- All-in cost is estimated on a pre-tax basis and includes all project operating costs, capital costs post-FID, and decommissioning costs divided by the estimated number of pounds U3O8 to be produced.

| Table 2 – Summary of Phoenix Economic Results (100% Basis) | ||

| Base Case | PFS Ref. Case(1) | |

| Uranium selling price | UxC Spot Price(2) (~USD$66 to USD$70/lb U3O8) | USD$65/lb U3O8 (Fixed selling price) |

| Exchange Rate (USD$:CAD$) | 1.35 | 1.30 |

| Discount Rate | 8% | 8% |

| Operating profit margin(3) | 90.9% | 89.9% |

| Pre-tax NPV8%(4) (Change from 2018 PFS)(7) | $2.34 billion (+150%) | $2.05 billion (+5%) |

| Pre-tax IRR(4) | 105.9% | 98.4% |

| Pre-tax payback period(6) | ~10 months | ~ 10 months |

| Post-tax NPV8%(4)(5) | $1.56 billion | $1.38 billion |

| Post-tax IRR(4)(5) | 90.0% | 83.9% |

| Post-tax payback period(5)(6) | ~10 months | ~ 11 months |

- The “PFS Reference Case” economic analysis reflects the outcome of the current Phoenix FS based on a uranium selling price that is the same as the “High Case” previously reported from the 2018 PFS, which was based on a fixed uranium selling price of USD$65 per pound U3O8 and a US to Canadian dollar exchange rate of 1.3 to 1. This case allows for a direct comparison of the NPV outcome from the Phoenix FS to the 2018 PFS.

- Spot price forecast is based on “Composite Midpoint” scenario from UxC’s Q2’2023 Uranium Market Outlook (“UMO”) and is stated in constant (not-inflated) dollars, see details below.

- Operating profit margin is calculated as aggregate uranium revenue less aggregate operating costs, divided by aggregate uranium revenue. Operating costs exclude all royalties, surcharges and income taxes.

- NPV and IRR are calculated to the start of construction activities for the Phoenix operation, and excludes $67.4 million in pre-FID expenditures.

- Post-tax NPV, IRR and payback period are based on the “adjusted Post-tax” scenario, discussed below, which includes the benefit of certain entity level tax attributes which are expected to be available and used to reduce taxable income from the Phoenix operation.

- Payback period is stated as number of months to payback from the start of uranium production.

- Change from 2018 PFS is computed by reference to the same scenario from the 2018 PFS, as discussed below, adjusted to incorporate certain pre-FID costs for consistent comparability.

Mineral Resource Estimate

The Phoenix mineral resource estimate has been updated to reflect 70 additional drill holes completed since the previous mineral resource estimate from 2018. The additional drilling consisted primarily of test wells installed to support ISR de-risking activities and certain targeted resource definition drill holes. As a result of the additional drilling, 30.9 million pounds U3O8 have been upgraded from Indicated mineral resources to Measured mineral resources in recognition of the increased confidence in certain areas of Phoenix Zone A.

The updated Phoenix mineral resource estimate, inclusive of mineral reserves, is summarized below. Mineral resources that are not mineral reserves do not have demonstrated economic viability at this time.

| Table 3 – Estimated Phoenix Mineral Resources (100% Basis) | ||||||

| Confidence Category | Domain | Volume (m³) | Density (g/cm³) | Tonnes (kt) | Average Grade (%U3O8) | Contained U3O8 (Mlbs) |

| Measured | ZoneA_HG | 6,729 | 3.84 | 25.9 | 50.7 | 28.9 |

| ZoneA_LG | 16,459 | 2.33 | 38.3 | 2.3 | 2.0 | |

| Total | 23,187 | 2.77 | 64.2 | 21.8 | 30.9 | |

| Indicated | ZoneA_HG | 8,773 | 3.37 | 29.6 | 42 | 27.4 |

| ZoneA_LG | 57,858 | 2.33 | 134.8 | 2.0 | 5.8 | |

| ZoneB_HG | 4,334 | 2.66 | 11.5 | 22.3 | 5.7 | |

| ZoneB_LG | 17,114 | 2.34 | 40.1 | 0.9 | 0.8 | |

| Total | 88,079 | 2.45 | 216.0 | 8.3 | 39.7 | |

| Total Measured and Indicated | 111,266 | 2.52 | 280,2 | 11.4 | 70.5 | |

| Inferred | ZoneA_Bsmt | 2,401 | 2.34 | 5,6 | 2.6 | 0.3 |

- The effective date of the mineral resource estimate is June 23, 2023. The Qualified Person (QP) for the estimate is Mr. Cliff Revering, P.Eng., an employee of SRK.

- Mineral resource estimates are prepared in accordance with CIM Definition Standards (CIM, 2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (CIM, 2019).

- Mineral resources are reported at a cut-off grade of 0.1% U3O8

- Mineral resources are reported using a uranium price of USD$55/lb.

- All figures have been rounded to reflect the relative accuracy of the estimate. Figures may not add due to rounding.

Mining Overview & Mineral Reserve Estimate

Phoenix is planned to be the first uranium ISR mining operation in the Athabasca Basin region. Comprehensive field and laboratory test work has been completed to de-risk the use of the ISR mining method at the Phoenix deposit – including the highly successful completion of the leaching and neutralization phases of the FFT at Phoenix in the fall of 2022. Over 3,300 data points have been collected within Phoenix to advance hydrogeological evaluations, and extensive groundwater flow modelling has been completed to develop an advanced three-dimensional estimation of the subsurface flows within and surrounding the Phoenix deposit. The data allowed for modelling of complex hydrogeological and geochemical datasets, which together with the uranium recovery curve, were used to estimate the rate of uranium dissolution within the orebody and facilitate the detailed wellfield design and production planning process.

The uranium recovery curve was obtained empirically from metallurgical testing completed at the Saskatchewan Research Council (“SRC”) facility under the supervision of industry experts. Over 125 kilograms (kg) of Phoenix mineralized samples were leached in a variety of settings, including intact cores under ISR conditions representative of the deposit, and column leaching and remediation tests representative of specific hydrogeological units (‘HGUs’) of the deposit. The results, including those from (i) the FFT (which confirm the early stages of the leaching curve), (ii) core leach test #4 (which was leached over 377 days to over 97% recovery), and (iii) core leach test #5 (which is representative of the HGU estimated to contain the largest mass of uranium in the deposit) were used to inform and validate the uranium recovery curve.

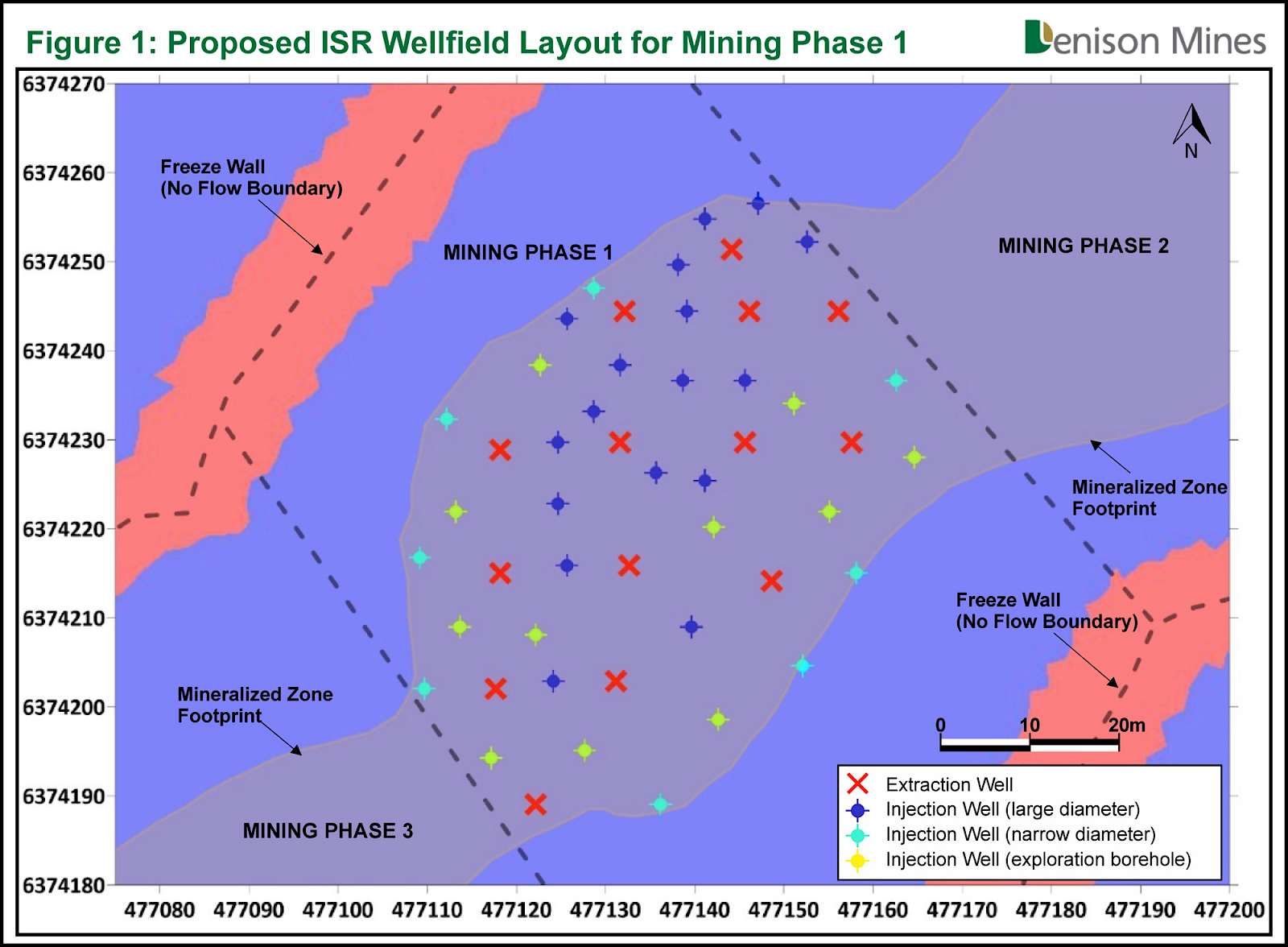

Based on the results of the mine planning process, mining activities have been divided into five phases, with a total of 74 extraction wells, 172 injection wells, and 22 monitoring wells, as outlined below:

| Table 4 –Wellfield composition for Phoenix by phase | |||

| Mining Phase | Extraction Wells | Injection Wells | Monitoring Wells |

| 1 | 14 | 36 | 6 |

| 2 | 12 | 30 | 4 |

| 3 | 13 | 32 | 4 |

| 4 | 23 | 44 | 4 |

| 5 | 16 | 30 | 6 |

| Total | 74 | 172 | 22 |

An illustration of the mine planning process is provided in Figure 1, which depicts the planned location of extraction, injection and monitoring wells within the Phase 1 mining area. In general, each extraction well is surrounded by 4 or more injection wells, the type of which has been selected and/or located to optimize cost and recovery.

Figure 1 – Proposed ISR Wellfield Layout for Mining Phase 1

A unique characteristic of the planned Phoenix ISR mine is the use of artificial ground freezing around the perimeter of the planned Phoenix mining phases to create a vertical hydraulic barrier surrounding the ISR mining area. The freeze perimeter is a tertiary containment measure, and is planned to consist of vertical freeze wells constructed from surface and extending into the impermeable lower basement rock underlying the deposit, which are designed to reduce the temperature of and freeze the ground adjacent to the wells to encircle the mining area with up to a 10-metre thickness of frozen ground.

Mining is planned to occur over a 10-year period, spanning 11 calendar years, with partial years of production occurring in both the first and final calendar year of the production plan. Progressive reclamation and decommissioning is planned to commence in each phase of the ore zone once production has ceased.

The Proven and Probable mineral reserves are estimated to be 56.7 million pounds U3O8. This estimate is based on the aggregate mine feed to the plant and represents 80.6% recovery of the total available uranium (U3O8 in the measured and indicated mineral resources. Proven mineral reserves are those which awere subject to a recovery test during the FFT in 2022.

| Table 5 – Phoenix Mineral Reserves (100% Basis) | |||

| Mining Phase by Confidence Category | Tonnes (kt) | Grade (% U3O8) | Recoverable U3O8 (Mlbs) |

| Proven | |||

| Phase 1 | 6.3 | 24.5 | 3.4 |

| Probable | |||

| Phase 1 | 41.3 | 20.2 | 18.4 |

| Phase 2 | 45.2 | 13.8 | 13.7 |

| Phase 3 | 20.3 | 11.0 | 4.9 |

| Phase 4 | 68.9 | 7.2 | 10.9 |

| Phase 5 | 37.0 | 6.6 | 5.4 |

| Total | 219.0 | 11.7 | 56.7 |

- The effective date of the mineral reserve estimate is June 23, 2023. The QP for the estimate is Mr. Dan Johnson, P.E., an employee of WSP.

- Mineral reserves are estimated at a cut-off grade of 0.5% U3O8 based on the ISR mining method using a long-term uranium price of USD$50/lb U3O8 and a USD$/CAD$ exchange rate of 1.33. The mineral reserves are based on mine operating cost of $0.78/lb U3O8, process operating cost of $5.20/lb U3O8, and process recovery of 99%, as discussed below.

Processing Overview

Consistent with the 2018 PFS, the Phoenix FS calls for the construction of a processing plant on the Wheeler River site, which has been designed to receive uranium bearing solution (“UBS”) from the wellfield for processing to a finished yellowcake product that meets industry standards.

An acidic lixiviant solution is prepared in the processing plant and transferred to an injection solution handling system for distribution in the wellfield. The solution is injected through a series of wells arranged in a pattern surrounding extraction / recovery wells, which are designed to pump the UBS up to surface once the lixiviant has travelled through the ore zone and dissolved the uranium from the host rock.

Once the UBS is received at the processing plant, removal of impurities such as iron (Fe) and radium (Ra) occur via Stage 1 (Fe/Ra) precipitation. Next the purified leach solution feeds the Stage 2 yellowcake precipitation circuit and the yellowcake product is dried and packaged for shipment. The processing plant has been designed based on an average uranium head grade of the UBS recovered from the wellfield of 22 grams per litre and is expected to recover 96.5% of the uranium feed contained in UBS after a 6 month ramp up period of the plant (when recovery is expected to be initially 93.4%). Taken together with planned subsequent recoveries of uranium contained in the Stage 1 (Fe/Ra) precipitation product, total recovered uranium of 56.2 million pounds U3O8 is planned to be available for sale – representing a combined 99% recovery rate.

Overall, the processing plant flowsheet remains largely consistent with the 2018 PFS; however, additional provisions have been included for effluent treatment via a three-stage neutralization process. Whereas the 2018 PFS assumed a “closed loop” processing system, the Phoenix FS design is aligned with the engineering components and criteria included in the Environmental Assessment (“EA”) for the project, which allow for the treatment of process solutions and controlled release of a treated effluent to the environment. This is an example of how the iterative nature of the EA process has informed project designs during the Phoenix FS process, to ensure that the plans are aligned and costed to meet or exceed environmental criteria expected to be required by the ongoing regulatory approval process. While this design for effluent treatment has been adopted for the Phoenix FS, the potential remains for ongoing FEED studies to optimize the processing plant design.

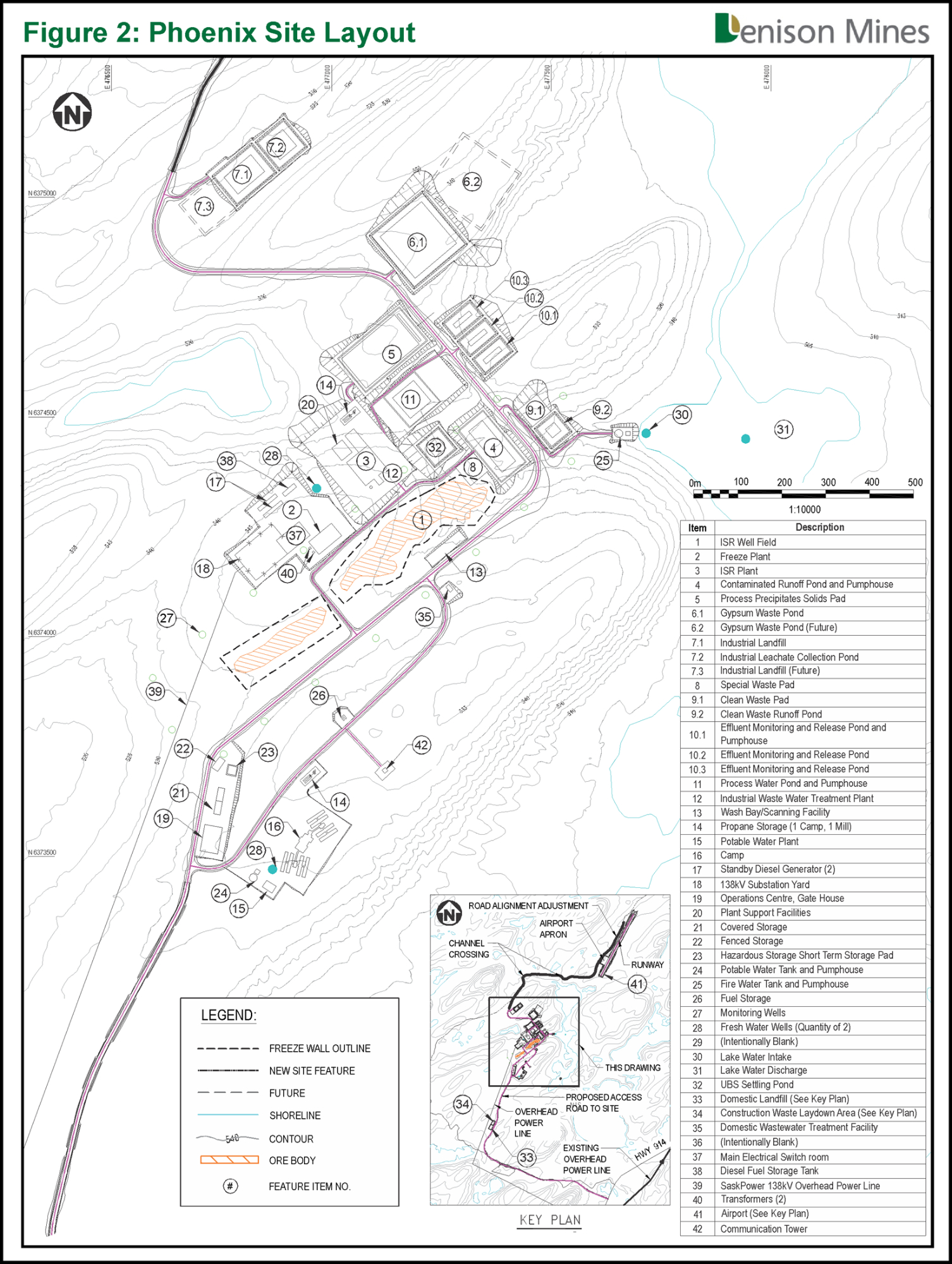

Site Infrastructure

The Phoenix site is compact and designed to limit environmental disturbance. The natural terrain of the area is used where advantageous, further reducing the impact of the project on the environment. Based on the Phoenix FS site layout, shown in Figure 2, the primary site facilities will consist of the ISR wellfield, ISR processing plant, freeze plant, storage pads, power substation and distribution, process ponds, and camp accomodations for between 100 and 150 occupants. These facilities are contained within an area estimated to be less than one square kilometre.

Figure 2 – Phoenix Site Layout

Additional on-site infrastructure includes a seven kilometre gravel road from Highway 914 to the site, electrical power line from the existing SaskPower transmission line located alongside Highway 914, airstrip, domestic and construction waste management areas, potable water treatment facilities, sewage treatment facilities, and fuel storage and distribution facilities.

Capital Costs

Initial capital costs are expected to be incurred during a 24-month construction period that will include the establishment of site infrastructure (discussed above), as well as the freeze wall perimeter around the Phase 1 mining zone and initial wellfield development within Phase 1.

| Table 6 – Phoenix Capital Costs ($ millions) | |||

| Initial | Sustaining | Total | |

| Wellfield | 63.0 | 177.1 | 240.1 |

| ISR processing plant | 102.6 | - | 102.6 |

| Surface facilities | 14.7 | 2.1 | 16.8 |

| Utilities | 34.8 | - | 34.8 |

| Electrical | 19.1 | - | 19.1 |

| Civil & earthworks | 39.6 | - | 39.6 |

| Decommissioning | - | 88.8 | 88.8 |

| Subtotal – Direct Costs | 273.8 | 268.0 | 541.8 |

| Indirect costs | 70.5 | 31.6 | 102.1 |

| Other (Owner’s) costs | 32.7 | - | 32.7 |

| Contingency | 42.6 | 23.3 | 65.9 |

| Total Capital Costs (100%) | 419.4 | 322.9 | 742.3 |

- Numbers may not add due to rounding.

Contingencies reflect approximately 11% of total capital costs, which is considered appropriate given the estimate was prepared to meet AACE Class 3 requirements, as well as Denison’s significant experience with key capital cost drivers through the completion of multiple field test programs at Phoenix since the 2018 PFS.

Operating Costs

Average estimated operating costs of $8.51 (USD$6.28) per pound U3O8 produced remain highly competitive amongst the lowest-cost uranium mining operations globally. Operating costs during the first five years of production are expected to be $6.64 (USD$4.90) per pound U3O8, benefitting from increased scale of operations and higher concentrations of uranium contained in recovered UBS. During the remaining years of production, operating costs are expected to be $13.69 (USD$10.10) per pound U3O8.

Table 7 – Phoenix Operating Cost per Pound U3O8 | ||

CAD$ | USD$ | |

Mining / Wellfield | 0.79 | 0.58 |

Processing | 5.25 | 3.88 |

Transport to converter | 0.24 | 0.18 |

Site support and administration | 2.23 | 1.64 |

Total Operating Costs per pound U3O8 | $8.51 | $6.28 |

- Numbers may not add due to rounding.

Uranium Selling Price Assumptions

The base-case economic analysis assumes uranium sales from Phoenix mine production will be made from time to time throughout the production period at the forecasted annual “Composite Midpoint” uranium spot price from the Q2’2023 Uranium Market Outlook (“UMO”) issued by UxC, LLC (“UxC”), which is stated annually in constant (non-inflated) 2023 dollars and ranges from ~USD$66 to USD$70 per pound U3O8 during the indicative production period of the Phoenix operation. This is the same pricing methodology applied for Phoenix as the base-case scenario in the 2018 PFS, where the “Composite Midpoint” uranium prices during the indicative years of production then ranged from only USD$29 to USD$45 per pound U3O8 in constant 2018 dollars. Consistent with the 2018 PFS, the overall cost profile and construction timeline of the planned Phoenix ISR mine is not expected to require substantial contract base loading to justify development. Accordingly, the spot price indicator from UxC has been used for the Phoenix base-case economic analysis.

The PFS reference case economic analysis reflects the outcome of the current Phoenix FS based on a uranium selling price that is the same as the “High Case” previously reported from the 2018 PFS, which was based on a fixed uranium selling price of USD$65 per pound U3O8 and a US to Canadian dollar exchange rate of 1.3 to 1. This case allows for a direct comparison of the NPV outcome from the Phoenix FS to the 2018 PFS.

Post-Tax Economic Analysis

The Phoenix FS considers two post-tax scenarios for the project’s base-case economic analysis. In the “Basic” post-tax scenario, Canadian federal income taxes plus provincial income taxes and profit-based royalties were calculated without incorporating the impact of the opening tax pool balances that are available to the applicable Wheeler River Joint Venture (“WRJV”) owners. The “Adjusted” post-tax scenario estimates the after-tax cash flows of the project by consolidating the expected entity-level after-tax cash flows for each of the parties to the WRJV and includes estimates of opening tax balances that are expected to be used to reduce taxable income. The impact of opening tax balances is significant and thus the “Adjusted” post-tax scenario is considered to better represent the true after-tax economic outcome to the owners of the project.

Table 8 – Phoenix Post-Tax Economic Analysis (Base Case) | ||

Basic | Adjusted | |

Post-Tax NPV8% | $1.43 billion | $1.56 billion |

Post-Tax IRR | 82.3% | 90.0% |

Post-Tax Payback Period | ~11 months | ~10 months |

Environmental Studies, Permitting and Social Impacts

The regulatory approval process and the legislation associated with the EA does not allow for the advancement of any project component before an EA decision is reached by the Saskatchewan Minister of Environment and the Canadian Nuclear Safety Commission (“CNSC”). For this reason, project advancement is gated by regulatory approvals and, while Denison plans to move towards construction readiness by advancing engineering design and planning activities, a FID cannot be made until necessary regulatory permission is granted.

The EA for the Phoenix ISR mine and process plant is well advanced through the Federal and Provincial approval process as guided by the Canadian Environmental Assessment Act 2012 and the Saskatchewan Environmental Assessment Act. The draft Environmental Impact Statement (“EIS”) was submitted in October 2022 and Denison has since received comments and information requests from the Provincial and Federal regulatory review teams and from Indigenous communities through the Federal public review process. Once the regulatory reviewers are satisfied with Denison’s responses to such comments, a final EIS will be submitted for ultimate approval.

Additionally, Denison will be required to make an application to the CNSC to obtain a license to construct a uranium mine and mill and to obtain a permit from the Saskatchewan Ministry of Environment to construct and operate a pollutant control facility. Denison has scheduled the submission of these applications such that the anticipated license and permit approvals align with the timing of the EA approval.

An important part of the regulatory review and approval process relates to engagement with Indigenous and non-Indigenous interested parties. Denison has carried out several years of engagement efforts related to the advancement of the project and in 2021 Denison’s Board of Directors adopted an Indigenous Peoples Policy (“IPP”), which sets out the Company’s guiding principles for and commitment to advancing reconciliation with Indigenous People. The IPP outlines Denison’s focus on specific efforts in relation to engagement, employment, environment, education, and empowerment, each of which support the advancement of sustainable mining operations.

Development Plans

The completion of the Phoenix FS is a key milestone to support the next phases of engineering design for the project. The FEED phase has already commenced and is expected to be completed before the end of the year. The objective of the FEED phase is to assess optimization opportunities and identify key long lead procurement requirements. Including the detailed design phase, project engineering efforts are expected to be completed in approximately two years. Upon engineering completion, construction is expected to last another two years. Assuming sufficient funding is secured by the owners of the WRJV, engineering and other pre-construction activities advance per plan, and timely receipt of required regulatory approvals, first production is currently anticipated to occur in 2027 or 2028.

Opportunities

Several opportunities for optimization have been identified during the FS completion process and are expected to be evaluated during the FEED phase, including (i) reducing the volume of treated effluent by increasing the recycling of solutions within the process plant; (ii) reducing the plant footprint by improving the FS conceptual layout and maximizing modularization of process equipment; (iii) reducing the size of certain site processing infrastructure through improved solids/liquid separation in the processing plant design; and (iv) modifications to the ISR mine model to incorporate potential operational optimization techniques to reduce the number of wells required to mine the deposit.

Completion of Phoenix ISR De-Risking

The Phoenix FS results reflect the culmination of a comprehensive and rigorous multi-year technical de-risking process that focused on assessing the key criteria necessary for the successful application of the ISR mining method to the specific characteristics of Phoenix.

In general, advancing ISR mining projects requires significant time and effort due to the extensive three-dimensional characterization and modeling required for project confidence. Forgoing detailed characterization efforts to accelerate project timelines or “simplify” the assessment process may substantially endanger long-term project success. The successful application of ISR in any geological setting largely depends on three fundamental requirements: (i) permeability (of the deposit), (ii) leachability (of the mineralization), and (iii) containment (of the mining solution).

Permeability

Hydrogeological investigations have been ongoing in the field and in laboratories since 2014. In-ground permeability tests conducted via a series of small-diameter test wells and large-diameter commercial scale wells (“CSWs”) have evaluated the physical flows and connections through the groundwater systems within the orebody. Pump and injection tests have collectively demonstrated the positive application of ISR at Phoenix. Additionally, packer, open hole, and cross hole tests have been completed in conjunction with drilling programs, and permeability tests have been completed on sections of available competent core from within Phoenix. Collectively, over 250 pump and injection tests and 3,120 permeameter samples have been collected over the deposit area.

Additional hydrogeological characterization, including borehole geophysics in over 43 wells, was completed to further refine the hydraulic sweep and vertical heterogeneity of the deposit.

In 2021, Denison completed an ISR field test program which included an ion tracer test utilizing a five-spot pattern of CSWs. The program was successful in demonstrating production flowrates assumed in the 2018 PFS, confirming hydraulic control of injected solutions during the ion tracer test, establishing breakthrough times between injection and recovery wells consistent with previous ‘Proof of Concept’ modelling, and showcasing the ability to remediate the test pattern by completing a ‘clean up phase’.

Leachability

Test programs conducted since 2017 included various forms of leaching tests, process plant circuit tests, and tests of effluent and solid waste streams treatment steps, to define design criteria for the Phoenix FS. Numerous column, batch, static, and core leach tests were conducted on defined hydrogeological and metallurgical units of the deposit to gain a comprehensive understanding of leachability and to ultimately define a recovery curve specific to the deposit. The collective tests have demonstrated excellent recovery of uranium from various deposit settings.

Containment

Proven freeze technology is planned to be used to surround the high-grade Phoenix deposit, within which an ISR wellfield of over 250 injection and recovery wells are planned to be installed. Permeability enhancement techniques have been tested extensively to validate augmentation of the natural hydrogeological flow paths to facilitate a higher degree of hydrological control. Through robust well design, achieved and validated through several years of field-based refinements, combined with adequately tested injection pressure and pumping rates, it has been collectively established that the coordinated process of pumping and injecting solutions into and from the wellfield serves as the primary means of containment, and that the freeze wall provides a tertiary control, which may provide opportunities for optimization during operations.

Completion of ISR De-Risking

In late 2022, after several years of systematic de-risking field and laboratory investigations, Denison completed the FFT, which was designed primarily to assess the effectiveness and efficiency of the leaching process in the ore zone. The first component of the test included the controlled injection of an acidic mining solution into the ore zone within a portion of the CSW test pattern installed in 2021 and the recovery of the solution back to the surface (“Leaching Phase”). The FFT was highly successful and resulted in the recovery of approximately 14,400 pounds U3O8 over 10 days of active leaching following completion of initial acidification of the leaching area. Through the completion of the second phase of the test (“Neutralization Phase”), the FFT also provided further evidence and validation of both permeability and containment assumptions. The completion of the leaching and neutralization phases of the FFT represents the conclusion of the final substantive scope of technical de-risking for the project.

Overall, the multi-year ISR de-risking process has supported Denison’s acquisition of extensive deposit-specific data and the development of a robust ISR mine planning model that involves evaluation of the production potential for individual well patterns.

With technical de-risking of the project substantively complete, evaluation efforts supporting the advancement of Phoenix are expected to focus on optimizing key areas of operations through FEED and advancing detailed design efforts in preparation for a future development decision.

Gryphon Underground Pre-Feasibility Study Update

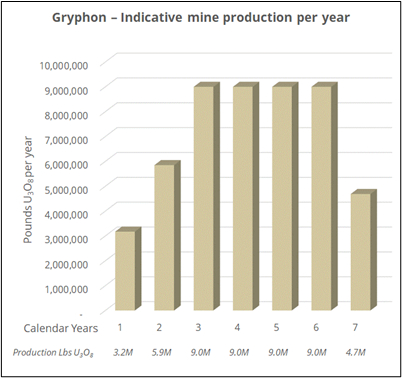

The 2018 PFS and the Gryphon Update describe the planned development of Gryphon as a conventional underground mine with a mine life of 6.5 years and annual average mine production of 7.6 million pounds U3O8. The Gryphon Update was prepared by Engcomp Engineering and Computing Professionals Inc. (“Engcomp”), SLR International Corporation (“SLR”), Stantec Consulting Ltd. (“Stantec”), and Hatch Ltd. (“Hatch”), and is largely based on the 2018 PFS, with efforts targeted at the review and update of capital and operating costs, as well as various minor scheduling and design optimizations. The study remains at the Pre-Feasibility ("PFS") level of confidence.

Overall, the Gryphon Update demonstrates that the underground development of Gryphon is a positive potential future use of cash flows generated from Phoenix, as it is able to leverage existing infrastructure to provide an additional source of low-cost production.

Table 9 – Summary of Key Gryphon Operation Parameters (100% Basis) | |

Mine life | 6.5 years |

Probable reserves(1) | 49.7 million lbs U3O8(1,275,000 tonnes at 1.8% U3O8) |

Average annual production | 7.6 million lbs U3O8 |

Initial capital costs(2) | $737.4 million |

Average cash operating costs | $17.27 (USD$12.75) per lb U3O8 |

All-in cost(3) | $34.50 (USD$25.47) per lb U3O8 |

- See below for additional information regarding Probable reserves.

- Initial capital costs exclude $56.5 million in pre-construction expenditures expected to be incurred prior to making a final investment decision (“FID”).

- All-in cost is estimated on a pre-tax basis and includes all project operating costs, capital costs post-FID, and decommissioning costs, divided by the estimated number of pounds U3O8 to be produced

Table 10 – Summary of Gryphon Economic Results (100% Basis) | ||

Base Case | PFS Ref. Case(1) | |

Uranium selling price | USD$75/lb U3O8(2) (Fixed selling price) | USD$65/lb U3O8 (Fixed selling price) |

Exchange Rate (USD$:CDN$) | 1.35 | 1.30 |

Discount Rate | 8% | 8% |

Operating profit margin(3) | 83.0% | 79.6% |

Pre-tax NPV8%(4) (Change from 2018 PFS)(7) | $1.43 billion (+148%) | $1.00 billion (-5%) |

Pre-tax IRR(4) | 41.4% | 34.0% |

Pre-tax payback period(6) | ~ 20 months | ~ 24 months |

Post-tax NPV8%(4)(5) | $864.2 million | $599.9 million |

Post-tax IRR(4)(5) | 37.6% | 30.6% |

Post-tax payback period(5)(6) | ~23 months | ~ 26 months |

- The “PFS Reference Case” economic analysis reflects the outcome of the current Phoenix FS based on a uranium selling price that is the same as the “High Case” previously reported from the 2018 PFS, which was based on a fixed uranium selling price of USD$65 per pound U3O8 and a US to Canadian dollar exchange rate of 1.3 to 1. This case allows for a direct comparison of the NPV outcome from the Phoenix FS to the 2018 PFS.

- Fixed selling price is based on the forecasted annual “composite Midpoint” long-term uranium price from UxC’s Q2’2023 UMO and is stated in constant (not-inflated) dollars, see details below.

- Operating profit margin is calculated as aggregate uranium revenue less aggregate operating costs, divided by aggregate uranium revenue. Operating costs exclude all royalties, surcharges and income taxes.

- NPV and IRR are calculated to the start of construction activities for the Gryphon operation, and excludes $5 million in pre-FID expenditures.

- Post-tax NPV, IRR and payback period for Gryphon are the same on a “Basic” and “Adjusted” basis, as entity level tax attributes are assumed to have been fully depleted by the Phoenix operation.

- Payback period is stated as number of months to payback from the start of uranium production.

- Change from 2018 PFS is computed by reference to the same scenario from the 2018 PFS, as discussed below, adjusted to incorporate certain pre-FID costs for consistent comparability.

Mineral Resource Estimate

The mineral resource estimate for Gryphon remains unchanged from the 2018 PFS. Using a cut-off grade of 0.2% U3O8, Gryphon is estimated to contain Indicated mineral resources of 1,643,000 tonnes, at a grade of 1.7% U3O8 for a total of 61.9 million pounds U3O8, plus Inferred mineral resources of 73,000 tonnes at a grade of 1.2% U3O8 for a total of 1.9 million pounds U3O8.

Mineral resources are stated inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Mining Overview & Mineral Reserve Estimate

The mine development and production plan for Gryphon remains largely the same as the 2018 PFS. Access to the deposit is planned to be via a primary production shaft with a diameter of 6.1 metres, installed using a blind boring method to a depth of 550 metres below surface. A ventilation shaft with a diameter of 5.8 metres, is also planned to be excavated via blind boring to a depth of 550 metres. Both shafts will be lined with a watertight steel/concrete composite liner.

Access from the shaft to the mine workings will be via a single ramp located on the hanging wall of the deposit. Mining is planned to consist of conventional underground longhole stoping mining methods, and is expected to primarily utilize a longitudinal retreat approach. Mined stopes will be backfilled using a combination of rockfill, cemented rockfill, and hydraulic fill.

Mining is expected to produce approximately 605 tonnes per day of ore and an average of 330 tonnes per day of waste rock during the steady-state operating period. While the mine has the potential to exceed this rate of production, the study constrains mine production based on expected processing capacity of 9 million pounds U3O8 per year (as discussed below).

The project development and construction schedule was reviewed during the completion of the Gryphon Update, and minor capital and scheduling efficiencies were found to allow for the deferral of some construction activities without an impact to the overall project schedule. These modifications have been reflected in timing of anticipated expenditures for Gryphon.

Overall, 49.7 million pounds U3O8 over 1,260,000 tonnes grading 1.8% U3O8 are planned to be extracted from Gryphon over an approximately 6.5-year mine life.

Table 11 – Gryphon Mineral Reserves (100% Basis) | |||

Confidence Category | Tonnes | Grade | Million lbs U3O8 |

Probable | 1,257,000 | 1.8 | 49.7 |

TOTAL | 1,257,000 | 1.8 | 49.7 |

- The effective date of the mineral reserve estimate is Sept 1 2018. The QP for the estimate is Mr. Mark Hatton, P.Eng., an employee of Stantec.

- The mineral reserve estimate was prepared in accordance with the CIM Definition Standards (CIM, 2014).

- Mineral Reserves are stated at a processing plant feed reference point.

- Mineral Reserves for the Gryphon deposit are estimated at a cut-off grade of 0.58% U3O8 based on longhole mining using a long-term uranium price of USD$50/lb and a USD$/CA$ exchange rate of 0.80. The mineral reserves are based on a mine operating cost of $150/t, mil operating cost of $275/t, G&A cost of $99/t, transportation cost of $50/t, milling recovery of 97%, and 7.25% fee for Saskatchewan royalties. Mineral reserves estimates account for diluting material and mining losses.

Processing Overview

Consistent with the 2018 PFS, production from the Gryphon operation is assumed to be processed at the 22.5% Denison-owned McClean Lake processing plant, which is located in the northeastern portion of the Athabasca Basin region. The results from the 2018 PFS indicate that the Gryphon deposit is amenable to recovery utilizing the existing flowsheet for the McClean Lake mill with minimal required upgrades and an estimated recovery rate of 98.2%.

The McClean Lake mill received a 10-year operating license from the CNSC in 2017 and is currently processing 100% of the mine production from the Cigar Lake mine under a toll milling agreement. Additionally, in early 2022, the McClean Lake operation was granted the final approval needed to amend its license to allow for an expansion of the tailings management facility on site.

Due to the volume of throughput expected from the Gryphon operation, the McClean Lake mill will require certain upgrades to process the mine production from Gryphon. Various other small upgrades are also expected to be required to achieve production at the licensed annual capacity of 24 million pounds U3O8. The study assumes that Cigar Lake production will decline from 18 million pounds U3O8, at present, to approximately 15 million pounds U3O8 at the time of co-processing with ore from the Gryphon operation. In order to assess compatibility with Gryphon mill feed and to approximate the split of estimated mill operating costs, various assumptions have been made in regard to the nature and quantity of the mill feed from the Cigar Lake mine. Denison's interest in the McClean Lake Joint Venture ("MLJV") does not entitle the Company or the WRJV to process its mine production at the facility in the absence of a toll milling agreement. Accordingly, certain further assumptions have been made regarding the likelihood and terms of a toll milling agreement with the MLJV. The estimated cost of production for Gryphon could be materially different should processing not be available at an existing local facility.

To facilitate access to the McClean Lake mill from the Wheeler River site, the Gryphon Update carries certain costs of building an extension to Highway 914 to connect the McArthur River and Cigar Lake operations and to allow for the transport of Gryphon mine production over an approximately 160 kilometre route.

Site Infrastructure

Due to its proximity to Phoenix, the Gryphon operation is expected to benefit from site infrastructure that is planned to be established in support of the Phoenix ISR mine (e.g., airstrip, camp, access road, power distribution). Additional site infrastructure for Gryphon is generally limited to items directly related to the underground mining operation, including incremental power distribution requirements, ore and waste rock handling, as well as mine water handling and treatment.

Capital Costs

Initial capital costs are expected to be incurred during a 42-month construction period that will include approximately 24 months for the completion of the production shaft and vent raise. Surface facilities, underground excavation, haulage road, and McClean Lake mill upgrades are expected to take approximately 18 months. Initial ore recovery occurs prior to the completion of construction and ramps up for the mine to achieve full production by year 3.

Table 12 – Gryphon Capital Costs ($ millions) | |||

Initial | Sustaining | Total | |

Shafts | 222.4 | - | 222.4 |

Surface facilities | 63.0 | 7.5 | 70.5 |

Underground | 63.9 | 86.2 | 150.1 |

Utilities | 5.3 | - | 5.3 |

Electrical | 5.4 | - | 5.4 |

Civil & earthworks | 16.0 | - | 16.0 |

McClean Lake mill upgrades | 67.9 | - | 67.9 |

Offsite infrastructure | 43.7 | - | 43.7 |

Decommissioning | - | 5.0 | 5.0 |

Subtotal – Direct Costs | 487.6 | 98.7 | 586.3 |

Indirect costs | 76.5 | 5.0 | 81.5 |

Other (Owner’s) costs | 25.6 | - | 25.6 |

Contingency | 147.7 | - | 147.7 |

Total Capital Costs (100%) | 737.4 | 103.7 | 841.1 |

- Numbers may not add due to rounding.

Contingencies reflect approximately 25% of total capital costs, which is considered appropriate given the estimate was prepared to meet AACE Class 4 requirements in alignment with the stage of engineering and design efforts for the project.

Operating Costs

Estimated operating costs of $17.27 (USD$12.75) per pound U3O8 produced remain highly competitive amongst the lowest-cost uranium mining operations globally.

Table 13 – Gryphon Operating Cost per Pound U3O8 | ||

CAD$ | USD$ | |

Mining | 6.85 | 5.05 |

Milling | 8.76 | 6.47 |

Transport to Converter | 0.27 | 0.20 |

Site support and administration | 1.40 | 1.03 |

Total Operating Costs per pound U3O8 | $17.27 | $12.75 |

- Numbers may not add due to rounding.

Uranium Selling Price Assumptions

The base-case economic analysis assumes uranium sales from Gryphon mine production will be made throughout the mine life at a fixed price of USD$75 per pound U3O8, which is based on the average of the forecasted annual “Composite Midpoint” long-term uranium price from UxC’s Q2’2023 UMO, which is stated in constant (non-inflated) 2023 dollars, during the indicative production period of Gryphon to the nearest USD$5 per pound U3O8. This is the same pricing methodology applied for Gryphon as the base-case scenario in the 2018 PFS, where the “composite Midpoint” long-term uranium price during the indicative years of production averaged ~USD$50 per pound U3O8 in then constant 2018 dollars. Consistent with the 2018 PFS, the overall cost profile and construction timeline of the planned Gryphon underground mine is considered to be more amenable to fixed (base escalated) price contracts with nuclear energy utilities to reduce risk and justify a development decision. Accordingly, the long-term price indicator from UxC has been used for the Gryphon base-case economic analysis.

The PFS reference case economic analysis reflects the outcome of the current Gryphon Update based on a uranium selling price that the same as the “High Case” previously reported from the 2018 PFS, which was based on a fixed uranium selling price of USD$65 per pound U3O8 and a US to Canadian dollar exchange rate of 1.3 to 1. This case allows for a direct comparison of the NPV outcome from the Gryphon Update to the 2018 PFS.

Post-Tax Economic Analysis

The Gryphon Update only considers one post-tax scenario for the project’s base-case economic analysis, as the there is no basis for an “adjusted” case, given that the entity level tax attributes of the WRJV owners are assumed to have been fully depleted by the Phoenix operation. In calculating the profit royalties and Canadian federal and provincial taxes payable for the Gryphon Update, it has been assumed that the Gryphon construction period will occur at a time when it will be allowable to deduct the pre-production expenditures against income from Phoenix that is not otherwise sheltered, thus the cash flow benefit of those deductions have been reflected prior to first production from Gryphon.

Permitting and Development Plans

At this time, Denison has not made a decision to advance Gryphon. While the project may benefit from certain infrastructure associated with the development of Phoenix, Gryphon is currently considered a stand-alone project. Gryphon is not expected to be subject to a Federal EA, as it would not meet the criteria of a designated activity as contemplated by the Physical Activities Regulations under the Impact Assessment Act (“IAA”), which replaced CEAA 2012 for projects commencing the regulatory review process after August 28, 2019.. If advanced into the permitting process, Gryphon will, however, remain subject to the requirement to complete an EA under the Saskatchewan Environmental Assessment Act, and will require (i) licensing by the CNSC and (ii) permitting by the Saskatchewan Ministry of Environment. The required licenses and permits cannot be issued until a decision on the Provincial EA has been made.

Opportunities

The Gryphon Update remains at the PFS level of confidence, and opportunities remain to complete additional studies to further advance confidence in the project plans. There are notable opportunities for optimization of the Gryphon mine design, including: (i) additional exploration drilling may increase estimated mineral resources, which with further studies could increase available probable reserves to support an extended mine life; (ii) increasing the shaft depth could improve the ramp up schedule of the mine and allow for earlier production; (iii) selecting a conventional method of shaft sinking by reusing ground freezing equipment potentially available from the Phoenix operation could improve schedule and reduce risks associated with blind boring; (iv) radiometric ore sorting underground could significantly reduce the quantity of ore to be transported to the mill for processing and could result in material reductions in transportation costs, milling costs, and (v) the addition of a grinding and leaching circuit at Gryphon to produce UBS to feed the processing plant proposed for the Phoenix operation, potentially reducing offsite infrastructure operating and capital costs associated with the upgrades needed for the McClean lake mill and the extension of Highway 914.

References & Reports:

For more information, see the press release dated June 26, 2023 and the “NI 43-101 Technical Report on the Wheeler River Project, Athabasca Basin, Saskatchewan, Canada” dated August 8, 2023 with an effective date of June 23, 2023.

The technical information has been reviewed and approved by Mr. Chad Sorba, P.Geo, Denison’s Director, Technical Services, and Mr. Andrew Yackulic, P. Geo., Denison's Director, Exploration, each of whom is a Qualified Person in accordance with the requirements of NI 43-101.

The Phoenix FS and Gryphon Update have been completed in accordance with NI 43-101, Canadian Institute of Mining, Metallurgy and Petroleum (CIM) standards, and best practices, as well as other standards such as the AACE Cost Estimation Standards. Other than as discussed herein and the risks identified in the Company’s Annual Information Form dated March 27, 2023 or subsequent quarterly financial reports filed under the Company’s profile on SEDAR and EDGAR, there are no known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources.

The qualified persons involved in the preparation of the Phoenix FS and Gryphon Update summarized in the press release from which this information was taken, and the related technical report, have followed industry accepted practices for verifying that the data used in the study is suitable for the purposes used. Data verification undertaken by Qualified Persons included review of drill core, review of quality assurance program and quality control measures and data, re-sampling and sample analysis programs, and database verification, as applicable. Validation checks were also performed on data. The independent Qualified Persons for the Phoenix FS, led by Wood’s David Myers P.Eng., have prepared the scientific and technical information on the Phoenix FS and reviewed the information that is summarized in the press release. Site visits by four of the Qualified Persons (Lorne Schwartz and David Myers from Wood, Cliff Revering from SRK and Dan Johnson from WSP, who each attended at Phoenix) was one element of such data verification procedures for the Phoenix FS. The independent Qualified Persons for the Gryphon Update, led by Engcomp’s Gord Graham P.Eng., have prepared the scientific and technical information on the Gryphon Update and reviewed the information that is summarized in the press release. Site visits by two of the qualified persons (Mark Mathieson from SLR at Gryphon and Will McCombe from Hatch at McClean Lake) was one element of the data verification procedures for the Gryphon Update.