News

Denison Provides Initial Progress Update on Installation of ISR Test Pattern at Wheeler River

TORONTO, April 21, 2021 /CNW/ - Denison Mines Corp. ("Denison" or the "Company") (TSX: DML) (NYSE American: DNN) is pleased to announce the initiation and ramp-up of In-Situ Recovery ("ISR") field test activities, including the installation of a five-spot ISR test pattern ("Test Pattern"), at the Company's 90% owned Wheeler River Uranium Project ("Wheeler River" or the "Project"). Mobilization of drilling equipment necessary to complete the large diameter drill holes, for each Commercial Scale Well ("CSW") planned for the Test Pattern, was completed in early April 2021 and, to date, four of the five planned CSWs have been successfully drilled to target depths, cased, and cemented into position. The fifth CSW is in progress and is expected to be completed within the next week. The installation of the Test Pattern is the first step in an ambitious 2021 ISR field program, which is designed to support the further de-risking of the application of the ISR mining method at the high-grade Phoenix uranium deposit ("Phoenix"). View PDF version.

David Bronkhorst, Denison's VP Operations, commented, "We are excited to have our 2021 ISR field program underway at Wheeler River. Our Saskatoon based technical team has assembled an industry-leading group of experts to design, install and operate the Test Pattern as part of our 2021 ISR field program. We are very pleased with the productivity achieved to date, for the installation of the large diameter CSWs, and are looking forward to further validating the effectiveness of various permeability enhancement tools and collecting additional hydrogeologic data to support the permitting and set-up of a lixiviant test in 2022. The lixiviant test is expected to be a key de-risking milestone for the Project – as it is intended to confirm technical feasibility by verifying the permeability, leachability, and containment parameters needed for the successful application of the ISR mining method at Phoenix."

The 2021 ISR field program is expected to involve the following key components:

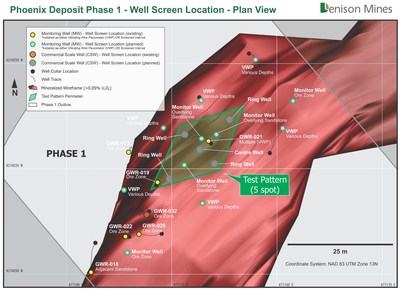

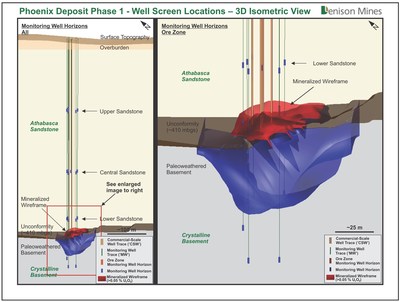

- Installation of a Five-spot Test Pattern: The Test Pattern is located in the Phase 1 area of the Phoenix deposit and is planned to consist of five new CSWs (see Figure 1 and Figure 2). The Test Pattern has been designed to facilitate the further evaluation of the ISR mining conditions at Phoenix – for incorporation into detailed mine planning that is expected to be completed as part of a future Feasibility Study ("FS") for the Project;

- Installation of 11 Additional Monitoring Wells ("MWs"): In addition to the existing small-diameter MWs, eleven further MWs are planned to be installed in the Phase 1 area (see Figure 1 and Figure 2) and are designed to surround the Test Pattern on all sides and above the ore zone horizon, in order to facilitate detailed monitoring of pressure changes and observations of fluid flow patterns during active hydrogeological tests. Certain MWs will also allow for water quality sampling over the duration of test work;

- Extensive Hydrogeologic Testing: Approximately twenty-five hydrogeologic tests are planned to be completed during the ISR field program. Tests are expected to (1) evaluate baseline conditions, (2) evaluate the effectiveness of permeability enhancement tools deployed on an individual well basis, and (3) assess the Test Pattern's total permeability on a full-scale basis. Additionally, ion tracer tests using inorganic salts are expected to be conducted on the full Test Pattern to establish breakthrough times for each CSW and confirm sub-surface pathways – thus allowing for a more complete understanding of the hydrogeologic characteristics expected throughout Phase 1, which is expected to support the permitting and design of a lixiviant test, planned for 2022, utilizing the existing Test Pattern.

Please refer to the Company's news release dated February 8, 2021 for additional details related to the Company's 2021 evaluation program plans for Wheeler River, which also includes information about the resumption of the Environmental Assessment process.

Phoenix Phase 1

As outlined in the Company's freeze wall trade-off study (see news release dated Dec. 1, 2020), Denison has decided to adapt its plans for the Project to use a freeze wall in future Project design and environmental assessment efforts. The trade-off study highlighted a key opportunity for the Project – whereby the freeze wall could be installed in stages to facilitate a phased mining approach at Phoenix. In a phased mining approach, only a limited portion of the freeze wall is required to support first production, with the subsequent expansion of the freeze wall perimeter allowing for additional mining phases to be brought into production over the duration of the mine life.

The phased mining approach is expected to allow for the targeted extraction of the least capital-intensive reserves first, based on the grade and distribution of ore in various areas of the deposit. The trade-off study provides for mining to occur over 5 phases.

Phase 1 of the deposit is estimated to contain approximately 22.2 million pounds U3O8 (37,242 tonnes at 27.1% U3O8, above a cut-off grade of 0.8% U3O8) in Probable mineral reserves. Based on current designs, the Company estimates approximately 6.6 million pounds U3O8 (7,717 tonnes at 39.2% U3O8, above a cut-off grade of 0.8% U3O8) in Probable mineral reserves are contained within the expected operating perimeter of the Test Pattern (see Figure 1). These estimates are derived as a direct subset of those reported in the Technical Report titled "Pre-feasibility Study for the Wheeler River Uranium Project, Saskatchewan, Canada" dated October 30, 2018 with an effective date of September 24, 2018. The key assumptions, parameters and methods used to estimate the mineral reserves herein remain unchanged.

COVID-19

The Company is committed to ensuring that the Wheeler River site is a safe operating environment for its staff and contractors and that the Company's field activities do not compromise the health and safety of the residents of northern Saskatchewan. In 2020, the Company's Occupational Health and Safety Committee in Saskatoon developed a comprehensive guide for the safe resumption of work at Wheeler River. The protocols consider the unique health and safety risks associated with operating a remote work camp amidst the ongoing COVID-19 pandemic. Public health guidelines and best practices (including testing) have been incorporated into the Company's protocols.

Despite the Company's current intentions, it is possible that the 2021 ISR field program may be disrupted by the continuously evolving social and/or economic disruptions associated with the COVID-19 pandemic, which are outside of the control of the Company – for example, the ability of Company or contractor staff to attend to the site, Provincial or local travel restrictions, and changing public health guidelines.

About Wheeler River

Wheeler River is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region, in northern Saskatchewan – including combined Indicated Mineral Resources of 132.1 million pounds U3O8 (1,809,000 tonnes at an average grade of 3.3% U3O8), plus combined Inferred Mineral Resources of 3.0 million pounds U3O8 (82,000 tonnes at an average grade of 1.7% U3O8). The project is host to the high-grade Phoenix and Gryphon uranium deposits, discovered by Denison in 2008 and 2014, respectively, and is a joint venture between Denison (90% and operator) and JCU (Canada) Exploration Company Limited (10%).

A PFS was completed for Wheeler River in late 2018, considering the potential economic merit of developing the Phoenix deposit as an ISR operation and the Gryphon deposit as a conventional underground mining operation. Taken together, the project is estimated to have mine production of 109.4 million pounds U3O8 over a 14-year mine life, with a base case pre-tax NPV of $1.31 billion (8% discount rate), Internal Rate of Return ("IRR") of 38.7%, and initial pre-production capital expenditures of $322.5 million. The Phoenix ISR operation is estimated to have a stand-alone base case pre-tax NPV of $930.4 million (8% discount rate), IRR of 43.3%, initial pre-production capital expenditures of $322.5 million, and industry leading average operating costs of US$3.33/lb U3O8. The PFS is prepared on a project (100% ownership) and pre-tax basis, as each of the partners to the Wheeler River Joint Venture are subject to different tax and other obligations.

Further details regarding the PFS, including additional scientific and technical information, as well as after-tax results attributable to Denison's ownership interest, are described in greater detail in the NI 43-101 Technical Report titled "Pre-feasibility Study for the Wheeler River Uranium Project, Saskatchewan, Canada" dated October 30, 2018 with an effective date of September 24, 2018. A copy of this report is available on Denison's website and under its profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.shtml.

Denison suspended certain activities at Wheeler River during 2020, including the EA process, which is on the critical path to achieving the project development schedule outlined in the PFS. While the EA process has resumed, the Company is not currently able to estimate the impact to the project development schedule outlined in the PFS, and users are cautioned against relying on the estimates provided therein regarding the start of pre-production activities in 2021 and first production in 2024.

About Denison

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. In addition to the Wheeler River project, Denison's interests in the Athabasca Basin include a 22.5% ownership interest in the McClean Lake joint venture ("MLJV"), which includes several uranium deposits and the McClean Lake uranium mill that is contracted to process the ore from the Cigar Lake mine under a toll milling agreement, plus a 25.17% interest in the Midwest and Midwest A deposits, and a 66.90% interest in the Tthe Heldeth Túé ("THT," formerly J Zone) and Huskie deposits on the Waterbury Lake property. The Midwest, Midwest A, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill. In addition, Denison has an extensive portfolio of exploration projects covering approximately 280,000 hectares in the Athabasca Basin region.

Denison is engaged in mine decommissioning and environmental services through its Closed Mines group (formerly Denison Environmental Services), which manages Denison's Elliot Lake reclamation projects and provides post-closure mine care and maintenance services to a variety of industry and government clients.

Denison is also the manager of Uranium Participation Corp., a publicly traded company which invests in uranium oxide and uranium hexafluoride.

Qualified Persons

The technical information contained in this release has been reviewed and approved by Mr. David Bronkhorst, P.Eng, Denison's Vice President, Operations, who is a Qualified Person in accordance with the requirements of NI 43-101.

Cautionary Statement Regarding Forward-Looking Statements

Certain information contained in this news release constitutes 'forward-looking information', within the meaning of the applicable United States and Canadian legislation, concerning the business, operations and financial performance and condition of Denison.

Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as 'plans', 'expects', 'budget', 'scheduled', 'estimates', 'forecasts', 'intends', 'anticipates', or 'believes', or the negatives and/or variations of such words and phrases, or state that certain actions, events or results 'may', 'could', 'would', 'might' or 'will be taken', 'occur', 'be achieved' or 'has the potential to'.

In particular, this news release contains forward-looking information pertaining to the following: the planned scope, elements, and objectives of the 2021 ISR field programs, including the drilling of CSWs and MWs and development of the Test Pattern; other evaluation activities, including a planned future lixiviant test and those connected with the EA process; the results of the PFS and expectations with respect thereto; expectations with respect to freeze wall containment and phased development, and the estimates of reserves in each such phase; other development and expansion plans and objectives, including plans for a feasibility study; and expectations regarding its joint venture ownership interests and the continuity of its agreements with its partners.

Forward looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those expressed or implied by such forward-looking statements. For example, the modelling and assumptions upon which the work plans are based may not be maintained after further testing or be representative of actual conditions within the Phoenix deposit. In addition, Denison may decide or otherwise be required to discontinue its field test activities or other testing, evaluation and development work at Wheeler River if it is unable to maintain or otherwise secure the necessary resources (such as testing facilities, capital funding, regulatory approvals, etc.) or operations are otherwise affected by COVID-19 and its potentially far-reaching impacts. Denison believes that the expectations reflected in this forward-looking information are reasonable but no assurance can be given that these expectations will prove to be accurate and results may differ materially from those anticipated in this forward-looking information. For a discussion in respect of risks and other factors that could influence forward-looking events, please refer to the factors discussed in Denison's Annual Information Form dated March 29, 2021 or subsequent quarterly financial reports under the heading 'Risk Factors'. These factors are not, and should not be construed as being exhaustive.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking information contained in this news release is expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this news release. Denison does not undertake any obligation to publicly update or revise any forward-looking information after the date of this news release to conform such information to actual results or to changes in Denison's expectations except as otherwise required by applicable legislation.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources and Probable Mineral Reserves: This press release may use the terms 'measured', 'indicated' and 'inferred' mineral resources. United States investors are advised that while such terms have been prepared in accordance with the definition standards on mineral reserves of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in Canadian National Instrument 43-101 Mineral Disclosure Standards ('NI 43-101') and are recognized and required by Canadian regulations, these terms are not defined under Industry Guide 7 under the United States Securities Act and, until recently, have not been permitted to be used in reports and registration statements filed with the United States Securities and Exchange Commission ('SEC'). 'Inferred mineral resources' have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally mineable. In addition, the terms "mineral reserve", "proven mineral reserve" and "probable mineral reserve" for the purposes of NI 43-101 differ from the definitions and allowable usage in Industry Guide 7. Effective February 2019, the SEC adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act and as a result, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". In addition, the SEC has amended its definitions of "proven mineral reserves" and "probable mineral reserves" to be "substantially similar" to the corresponding definitions under the CIM Standards, as required under NI 43-101. However, information regarding mineral resources or mineral reserves in Denison's disclosure may not be comparable to similar information made public by United States companies.

Figure 1: Plan Map Showing Location of Phoenix Deposit (Phase 1) – ISR Test Pattern

SOURCE Denison Mines Corp.