News

Denison Reports Results from Wheeler River PFS, Including +275% Increase in Pre-Tax NPV and Selection of ISR Mining Method for Phoenix Deposit

TORONTO, Sept. 24, 2018 /CNW/ - Denison Mines Corp. ("Denison" or the "Company") (DML: TSX, DNN: NYSE American) is pleased to announce the results of the Pre-Feasibility Study ("PFS") on its flagship Wheeler River uranium project ("Wheeler River") in northern Saskatchewan. The PFS has been completed in accordance with NI 43-101 and is highlighted by the selection of the in-situ recovery ("ISR") mining method for the development of the Phoenix deposit, with an estimated average operating cost of $4.33 (US$3.33) per pound U3O8. View PDF version.

The PFS considers the potential economic merit of co-developing the Phoenix and Gryphon deposits. The high-grade Phoenix deposit is designed as an ISR mining operation, with associated processing to a finished product occurring at a plant to be built on site at Wheeler River. The Gryphon deposit is designed as an underground mining operation, utilizing a conventional long hole mining approach with processing of mine production assumed at Denison's 22.5% owned McClean Lake mill. Taken together, the project is estimated to have mine production of 109.4 million pounds U3O8 over a 14-year mine life, with a base case pre-tax Net Present Value ("NPV") of $1.31 billion (8% discount rate), Internal Rate of Return ("IRR") of 38.7%, and initial pre-production capital expenditures of $322.5 million.

The base-case economic analysis assumes uranium sales are made at UxC Consulting Company, LLC's ("UxC") annual estimated spot price for mine production from the Phoenix deposit (from ~US$29/lb U3O8 to US$45/lb U3O8), and a fixed price for mine production from the Gryphon deposit (US$50/lb U3O8).

Using the same price assumed for the project's 2016 Preliminary Economic Assessment ("2016 PEA"), a fixed uranium price of US$44/lb U3O8 ("PEA Reference Case"), the PFS produces a combined pre-tax project NPV of $1.41 billion – representing a roughly 275% increase from the $513 million pre-tax project NPV estimated in the 2016 PEA.

The PFS is prepared on a project (100% ownership) and pre-tax basis, as each of the partners to the Wheeler River Joint Venture ("WRJV") are subject to different tax and other obligations. After-tax results attributable to Denison's ownership interest are provided under the heading "Indicative Denison Post-Tax Results". All amounts are in Canadian dollars unless otherwise noted.

David Cates, President and CEO of Denison, commented "The selection of ISR mining for the high-grade Phoenix deposit is a defining moment for our Company and a potentially transformational development for the future of uranium mining in the Athabasca Basin – bringing the world's lowest cost uranium mining method to the jurisdiction hosting the world's highest-grade uranium deposits."

Mr. Cates further added, "Based on an estimated production cost of US$3.33/lb U3O8 and relatively modest initial capital costs, the Phoenix operation is expected to have superior leverage to an anticipated recovery of the spot price of uranium – owing to the fact that the operation may not require a book of long-term contracts to support a development decision. The Gryphon deposit is a perfect complement to Phoenix, as it is expected to supply additional low-cost pounds, financed through cash flow from Phoenix, at a time when the uranium market is expected to be in a significant supply deficit."

Conference Call

The Company will host a conference call and live webinar on Tuesday September 25, 2018 at 8:15 a.m. Eastern Daylight Time. During the call, management will provide an overview of the results of the PFS and will also accept questions from analysts and other participants. To join the call please dial (604) 638-5340 (Local/International) or 1-800-319-4610 (North America Toll Free).

To access the conference call and live webinar via the internet, please use the following link prior to the start of the call: http://services.choruscall.ca/links/denisonmines20180925.html

A recorded version of the conference call will be available on our website (www.denisonmines.com) shortly after the call, or by telephone via the following playback numbers (604) 674-8052 (Local/International) or 1-855-669-9658 (North America Toll Free) using the access code, 2611.

Pre-Feasibility Study Highlights

- Phoenix delivers exceptional operating costs and manageable initial capex with ISR

Mine life | 10 years (6.0 million lbs U3O8 per year on average) |

Probable reserves(1) | 59.7 million lbs U3O8 (141,000 tonnes at 19.1% U3O8) |

Average cash operating costs | $4.33 (US$3.33) per lb U3O8 |

Initial capital costs | $322.5 million |

Base case pre-tax IRR(2) | 43.3% |

Base case pre-tax NPV8%(2) | $930.4 million |

Base case price assumption | UxC spot price(3) (from ~US$29 to US$45/lb U3O8) |

Operating profit margin(4) | 89.0% at US$29/lb U3O8 |

All-in cost(5) | $11.57 (US$8.90) per lb U3O8 |

(1) | See below for additional information regarding Probable reserves; |

(2) | NPV and IRR are calculated to the start of pre-production activities for the Phoenix operation in 2021; |

(3) | Spot price forecast is based on "Composite Midpoint" scenario from UxC's Q3'2018 Uranium Market Outlook ("UMO") and is stated in constant (not-inflated) dollars; |

(4) | Operating profit margin is calculated as uranium revenue less operating costs, divided by uranium revenue. Operating costs exclude all royalties, surcharges and income taxes; |

(5) | All-in cost is estimated on a pre-tax basis and includes all project operating costs and capital costs, divided by the estimated number of pounds U3O8 to be produced. |

- Gryphon leverages existing infrastructure and provides additional low-cost production

Mine life | 6.5 years (7.6 million lbs U3O8 per year on average) |

Probable reserves(1) | 49.7M lbs U3O8 (1,257,000 tonnes at 1.8% U3O8) |

Average cash operating costs | $15.21 (US$11.70) per lb U3O8 |

Initial capital costs | $623.1 million |

Base case pre-tax IRR(2) | 23.2% |

Base case pre-tax NPV8%(2) | $560.6 million |

Base case price assumption | US$50 per pound U3O8 |

Operating profit margin(3) | 77.0% at US$50/lb U3O8 |

All-in cost(4) | $29.67 (US$22.82) per lb U3O8 |

(1) | See below for additional information regarding Probable reserves; |

(2) | NPV and IRR are calculated to the start of pre-production activities for the Gryphon operation in 2026; |

(3) | Operating profit margin is calculated as uranium revenue less operating costs, divided by uranium revenue. Operating costs exclude all royalties, surcharges and income taxes; |

(4) | All-in cost is estimated on a pre-tax basis and includes all project operating costs and capital costs, divided by the estimated number of pounds U3O8 to be produced. |

- Selection of ISR mining method for high-grade Phoenix deposit – Following the completion of the 2016 PEA, the Company evaluated 32 alternate mining methods to replace the high-cost Jet Bore Mining System ("JBS") assumed for the Phoenix deposit in the 2016 PEA. The suitability of ISR mining for Phoenix has been confirmed by significant work completed in the field and laboratory – including drill hole injection, permeability, metallurgical leach, agitation, and column tests. Results demonstrate high rates of recovery in both extraction (+90%) and processing (98.5%) following a simplified flow sheet that precipitates uranium directly from the uranium bearing solution ("UBS"), without the added costs associated with ion exchange or solvent extraction circuits.

- Novel application of established mining technologies – Given the unique geological setting of the Phoenix deposit, straddling the sub-Athabasca unconformity in permeable ground, the project development team has combined the use of existing and proven technologies from ISR mining, ground freezing, and horizontal directional drilling to create an innovative model for in situ uranium extraction in the Athabasca Basin. While each of the technologies are well established, the combination of technologies results in a novel mining approach applicable only to deposits occurring in a similar geological setting to Phoenix – which now represents the first deposit identified for ISR mining in the Athabasca Basin.

- Environmental advantages of ISR mining at Phoenix – The Company's evaluation of the ISR mining method for Phoenix has also identified several significant environmental and permitting advantages, namely the absence of tailings generation, the potential for no water discharge to surface water bodies, and the potential to use the existing Provincial power grid to operate on a near zero carbon emissions basis. In addition, the use of a freeze wall, to encapsulate the ore zone and contain the mining solution used in an ISR operation, eliminates common environmental concerns associated with ISR mining and facilitates a controlled reclamation of the site. Taken together, the Phoenix operation has the potential to be one of the most environmentally friendly mining operations in the world. Owing largely to these benefits, consultation with regulatory agencies and stakeholder communities, to date, has been encouraging regarding the use of ISR mining.

Wheeler River Project

The Wheeler River project is the largest undeveloped uranium project in the eastern portion of the Athabasca Basin region in northern Saskatchewan, Canada. The project is situated in close proximity to important regional infrastructure, including the Provincial electrical transmission grid and an all-season Provincial highway. Since Denison became the operator of the project in 2004, two high-grade uranium deposits have been discovered and now account for combined Mineral Reserves and Mineral Resources as follows:

- Probable Mineral Reserves of 109.4 million pounds U3O8 (Phoenix 59.7 million pounds U3O8 from 141,000 tonnes at 19.1% U3O8; Gryphon 49.7 million pounds U3O8 from 1,257,000 tonnes at 1.8% U3O8);

- Indicated Mineral Resources (inclusive of Reserves) of 132.1 million pounds U3O8 (1,809,000 tonnes at an average grade of 3.3% U3O8); plus

- Inferred Mineral Resources of 3.0 million pounds U3O8(82,000 tonnes at an average grade of 1.7% U3O8).

The PFS does not include any economic analysis based on estimated Inferred Mineral Resources.

The project is a joint venture between Denison (63.3% and operator), Cameco (26.7%), and JCU (Canada) Exploration Company Limited ("JCU") (10%). Denison is increasing its ownership in the project to up to 90% under two recently announced agreements with Cameco. See Denison press releases dated January 10, 2017 and September 4, 2018 for details.

Pre-Feasibility Study Summary

The objective of the PFS is to assess the technical and economic viability of achieving uranium production at Wheeler River. A team of technical experts, including Stantec Consulting Inc. (Gryphon shaft and mine design), Hatch Ltd. (McClean Lake mill modifications), Woodard and Curran Inc. (Phoenix ISR wellfield and mineral processing designs), Newmans Geotechnique Inc. (Phoenix ground freezing design), SRK Consulting (Environmental and social considerations, including water treatment plant design), RPA Inc. (Mineral Resource estimates), and ENGCOMP Engineering and Computing Professionals Inc. (Surface infrastructure design), have been retained by Denison to contribute to, and author, the PFS for the Wheeler River project. The conclusion of the PFS process follows months of engineering and trade-off studies carried out by the Company after the completion of the 2016 PEA. The results from the 2016 PEA informed the Company's focus during the PFS process and ultimately led to the determination that a new mining method was warranted for the development of the Phoenix deposit.

The Phoenix ISR operation and Gryphon underground operation are estimated to produce combined total mine production of 109.4 million pounds U3O8 over a 14-year mine life. Pre-production activities are estimated to begin in 2021, assuming receipt of required regulatory approvals, with first production from the Phoenix deposit expected in 2024.

Table 1 – Wheeler River PFS Financial Results (100% Basis) | |

Base case pre-tax NPV8%(1) | $1.31 billion |

Base case pre-tax "IRR (1) | 38.7% |

Base case pre-tax payback period(2) | ~24 months |

Initial capital costs(3) | $322.5 million |

Average annual mine production | 7.8 million lbs U3O8 |

Mine life | 14 years |

Exchange rate(4) (US$:CDN$) | 1:1.30 |

Discount rate | 8.00% |

(1) | NPV and IRR are calculated to the start of pre-production activities for the Phoenix operation in 2021; |

(2) | Payback period is stated as number of months to pay-back from the start of uranium production; |

(3) | Initial capital costs for the Wheeler River project are the initial capital costs estimated for Phoenix; |

(4) | Exchange rate applied on uranium sales. |

Table 2 – Wheeler River Reserve Statement (100% Basis) | ||||

Deposit | Classification | Tonnes | Grade | Lbs U3O8 |

Phoenix | Probable | 141,000 | 19.1% | 59.7 million |

Gryphon | Probable | 1,257,000 | 1.8% | 49.7 million |

Total | Probable | 1,398,000 | 3.5% | 109.4 million |

Notes: | |

(1) | Reserve statement is as of September 24, 2018; |

(2) | CIM definitions (2014) were followed for classification of mineral reserves; |

(3) | Mineral reserves for the Phoenix deposit are reported at the mineral resource cut-off grade of 0.8% U3O8. The mineral reserves are based on the block model generated for the May 28, 2014 mineral resource estimate. A mining recovery factor of 85% has been applied to the mineral resource above the cut-off grade; |

(4) | Mineral reserves for the Gryphon deposit are estimated at a cut-off grade of 0.58% U3O8 using a long-term uranium price of USD$40/lb, and a USD$/CAD$ exchange rate of 0.80. The mineral reserves are based on the block model generated for the January 30, 2018 mineral resource estimate. The cut-off grade is based on an operating cost of CAD$574/tonne, milling recovery of 97%, and 7.25% fee for Saskatchewan royalties; |

(5) | Mineral reserves include diluting material and mining losses; |

(6) | Mineral reserves are stated at a processing plant feed reference point; |

(7) | Numbers may not add due to rounding. |

The PFS has been completed in accordance with NI 43-101, Canadian Institute of Mining, Milling and Petroleum (CIM) standards and best practices, as well as other standards such as the AACE Cost Estimation Standards. The NI 43-101 technical report, supporting the PFS results included in this news release, is in the process of being finalized and will be provided to the WRJV partners for their review in connection with an upcoming management committee meeting and filed under Denison's profile on SEDAR within 45 days of this release. This press release expresses the views and opinions of Denison, as operator of the WRJV, and does not necessarily represent the views of the individual WRJV partners.

Price Assumptions & Sensitivities

The base-case economic analysis assumes uranium sales from Phoenix mine production will be made from time to time throughout production at UxC's forecasted annual "Composite Midpoint" spot price from the Q3'2018 Uranium Market Outlook ("UMO"), which is stated annually in constant (non-inflated) 2018 dollars and ranges from ~US$29/lb U3O8 to US$45/lb U3O8 during the 10 year estimated life of the Phoenix operation. For mine production from the Gryphon operation, a fixed price of US$50/lb U3O8 has been assumed for uranium sales.

The base-case pricing scenario is intended to be representative of how Denison expects to evaluate the business case for advancing development of each of the proposed Phoenix and Gryphon operations. The Phoenix operation is not expected to require substantial contract base loading to justify development – given estimated operating costs of US$3.33/lb U3O8, resulting in highly attractive operating profit margins (+90%) with the ability to absorb the price variability associated with the uranium spot market. While the Gryphon operation is also expected to have low operating costs (US$11.70/lb U3O8), its overall cost profile is considered to be more amenable to fixed (base escalated) price contracts with nuclear energy utilities, in order to reduce risk and justify a development decision.

Additional pricing scenarios are provided using a project wide fixed selling price of US$44/lb U3O8 (the "PEA Reference Case"), to facilitate comparison to the 2016 PEA, and at US$65/lb U3O8 (the "High Case"), to illustrate the potential for the project to benefit from rising uranium prices.

Table 3 – Sensitivity of Wheeler River to Uranium Pricing Scenarios (100% Basis) | |||

Base Case | PEA Ref. Case | High Case | |

Uranium price | As above | US$44.00/lb U3O8 | US$65.00/lb U3O8 |

Pre-tax NPV8%(1) | $1.31 billion | $1.41 billion | $2.59 billion |

Pre-tax IRR(1) | 38.7% | 47.4% | 67.4% |

Pre-tax payback period(2) | ~24 months | ~ 15 months | ~ 11 months |

(1) | NPV and IRR are calculated to the start of pre-production activities for the Phoenix operation in 2021; |

(2) | Payback period is stated as number of months to pay-back from the start of uranium production. |

The Phoenix Operation

Overview

- Phoenix is a unique high-grade Athabasca Basin deposit amenable to ISR mining;

- Test results indicate strong ISR well field (+90%) and processing (98.5%) recoveries with UBS concentrations in the 12 to 20 grams per litre (g/l) range – leading to simplified on-site processing plant design, without ion exchange or solvent extraction circuits;

- Expected mine life of 10 years with total mine production of 59.7 million pounds U3O8 and an annual average mine production rate of approximately 6.0 million pounds U3O8;

- Estimated to have exceptionally low operating costs (US$3.33/lb U3O8), and comparatively low upfront capital costs for a large-scale uranium mining operation;

- Opportunity to be one of the most environmentally friendly mining operations in the world, owing to minimal surface disturbance, no tailings generation, potential for no water discharge, a controlled restoration process, and access to the Provincial power grid – resulting in a potentially near zero carbon emission mine site during operations;

- Elimination of key ISR concerns by using a freeze cap to contain mining solutions during operations and to facilitate the restoration process; and

- Short timeline to production with the capability to scale production to meet market demands.

Table 4 – Phoenix Operation Summary of Economic Results | ||

Base Case | High Case | |

Uranium selling price | UxC Spot Price(1) | US$65/lb U3O8 |

Operating profit margin(2) | 91.4% | 95.0% |

Pre-tax NPV8%(3) (100%) | $930.4 million | $1.91 billion |

Pre-tax IRR(3) | 43.3% | 71.5% |

Pre-tax payback period(4) | ~21 months | ~ 11 months |

(1) | Spot Price is based on the "Composite Midpoint" spot price scenario from UxC's UMO; |

(2) | Operating profit margin is calculated as aggregate uranium revenue less aggregate operating costs, divided by aggregate uranium revenue. Operating costs exclude all royalties, surcharges and income taxes; |

(3) | NPV and IRR are calculated to the start of pre-production activities for the Phoenix operation in 2021; |

(4) | Payback period is stated as number of months to pay-back from the start of uranium production. |

Table 5 – Phoenix Operating Cost per Pound U3O8 | ||

CDN$ | US$ | |

Mining / Wellfield | 0.75 | 0.58 |

Milling / Processing | 1.97 | 1.51 |

Transport to converter | 0.21 | 0.16 |

Site support and administration | 1.40 | 1.08 |

Total Operating Costs per pound U3O8 | $4.33 | $3.33 |

Table 6 – Phoenix Capital Costs ($ millions) | |||

Initial | Sustaining | Total | |

Wellfield | 63.7 | 35.4 | 99.1 |

ISR processing plant | 50.9 | 4.6 | 55.5 |

Water treatment plant | 1.3 | 18.7 | 20.0 |

Surface facilities | 22.3 | 0.1 | 22.4 |

Utilities | 6.5 | 0.8 | 7.3 |

Electrical | 18.8 | - | 18.8 |

Civil & earthworks | 44.3 | 1.3 | 45.6 |

Offsite infrastructure | 8.0 | - | 8.0 |

Decommissioning | - | 27.5 | 27.5 |

Subtotal – Direct Costs | 215.8 | 88.4 | 304.2 |

Indirect costs | 28.3 | 5.7 | 34.0 |

Other (Owner's) costs | 14.2 | - | 14.2 |

Contingency | 64.2 | 9.4 | 73.6 |

Total Capital Costs (100%) | 322.5 | 103.5 | 426.0 |

Deposit & Geology

The Phoenix deposit is the highest-grade undeveloped uranium deposit in the world, geologically situated at or immediately above the unconformity between the Athabasca Basin sandstone and older basement rocks, approximately 400 metres below surface. Mineralization has been defined over a strike length of approximately one kilometre and is coincident with a significant steeply dipping fault zone. A total of 196 drill holes have delineated two distinct zones (A and B) of high-grade uranium mineralization lying horizontally along the unconformity. At a cut-off grade of 0.8% U3O8 the Phoenix deposit is estimated to contain Indicated Mineral Resources of 166,400 tonnes, at a grade of 19.14% U3O8 for a total of 70.2 million pounds U3O8, plus Inferred Mineral Resources of 8,600 tonnes at a grade of 5.80% U3O8 for a total of 1.1 million pounds U3O8. For further details, see the Company's report entitled "Technical Report with an Updated Mineral Resource Estimate for the Wheeler River Property, Northern Saskatchewan, Canada" dated March 15, 2018 (the "Resource Report"), as filed on SEDAR and available on the Company's website. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Selection of ISR Mining Method

After completion of the 2016 PEA, Denison initiated a detailed review of the development plan for the Phoenix deposit – which had been designed as an underground mine using JBS mining as the extraction technology. The 2016 PEA identified disadvantages associated with JBS mining, including technical risk, comparatively high operating and capital costs, as well as long pre-production construction timelines.

Accordingly, following completion of the 2016 PEA, Denison initiated an extensive review process, seeking suitable alternative mining methods for the Phoenix deposit. A total of 32 different mining methods were identified, reviewed, and subsequently shortlisted through an increasingly rigorous evaluation process. ISR mining was ultimately selected as the preferred mining method due to significant economic, environmental, and technical advantages.

ISR Mining Process

ISR mining has become the industry leading low-cost uranium production method globally – following on from initial use in the 1960s to extensive use at present in Kazakhstan (the world's largest and lowest cost producer of uranium), the United States, China, Russia, and Australia, amongst others. ISR mining is amenable to uranium deposits in certain sedimentary formations and is well known in the industry for comparatively minimal surface impact, high production flexibility, and low operating and capital costs. In 1998, ISR mining represented roughly 13% of global uranium production, increasing rapidly to the point where today it is estimated to account for over 50% of global uranium production. There has been continuous development and improvement of ISR mining techniques in past years, particularly in the two decades since the International Atomic Energy Agency ("IAEA") published the Manual of Acid In-Situ Leach Uranium Mining Technology (IAEA-TECDOC-1239).

ISR mining involves recovery of uranium by pumping a mining solution (also referred to as a "lixiviant") through an appropriately permeable orebody. The method eliminates the need to physically remove ore and waste from the ground – thus eliminating the related surface disturbance and tailings normally related to underground or open pit operations. The mining solution dissolves the uranium as it travels through the ore zone – effectively reversing the natural process that originally deposited the uranium. The mining solution is injected into the ore zone through a series of four-inch cased drill holes called injection wells and pumped back to surface via a similar series of recovery wells. Once on surface, the UBS is sent to a surface processing plant for the chemical separation of the uranium. Following the uranium removal, the mining solution is reconditioned (often referred to as the barren mining solution) and returned back to the well field for further production.

While ISR mining is not currently being used in Canada for uranium mining, the Phoenix deposit has all the attributes necessary to be a successful ISR operation, as outlined below:

- Mineralization that is situated in permeable ground, allowing the mining solution to travel from the injection well through the orebody and ultimately back to surface via a recovery well;

- Mineralization that is readily dissolvable by the mining solution; and

- Mineralization that is within a setting which allows for containment of the mining solution – such that the mining solution can be recovered without contaminating the environment or being diluted by natural ground water.

Many of the large undeveloped uranium deposits discovered in the Athabasca Basin in recent years (namely Arrow, Triple R, Gryphon, Millennium, and Roughrider) are hosted within basement rocks, which are not amenable to ISR mining due to the low permeability of the host rock.

As ISR mining is a novel mining method for the Athabasca Basin, there is risk that the Company may not be able to complete ISR operations as outlined in the PFS and/or that the costs could be materially different than estimated.

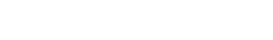

Phoenix Freeze Cap

In conventional ISR operations, containment of the mining solution is typically achieved by naturally impermeable bounding layers in the geological strata and/or by creating a natural drawdown (via pumping) of the water table towards the ore zone. At Phoenix, there is a natural impermeable layer below the deposit, in the form of a competent package of basement rocks, but the deposit is otherwise hydraulically connected to the vast regional groundwater system in the overlying sandstone formation that defines the Athabasca Basin. To contain the mining solution within the ore zones, an artificial freeze cap is planned to encapsulate the deposit. While this is a novel concept, ground freezing technology is well established throughout the world and is already in use in the Athabasca Basin in different applications.

The freeze cap will be established by drilling parallel cased holes from surface, starting at either end of the deposit and travelling horizontally along the long axis of the deposit anchoring into the impermeable basement rock on the opposite end of the deposit. This is expected to be achievable using modern directional drilling techniques. Circulation of a low temperature brine solution through the cased drill holes will freeze the groundwater within the sandstone rock and ultimately create an impermeable freeze wall, expected to be roughly 10 metres thick, surrounding the deposit on all sides and above, without freezing the actual ore zone.

Due to the novel approach proposed for drilling of the freeze holes, there is risk that the Company may not be able to complete drilling as planned, which could materially increase cost estimates.

See Figure 1 for illustration of Phoenix freeze cap

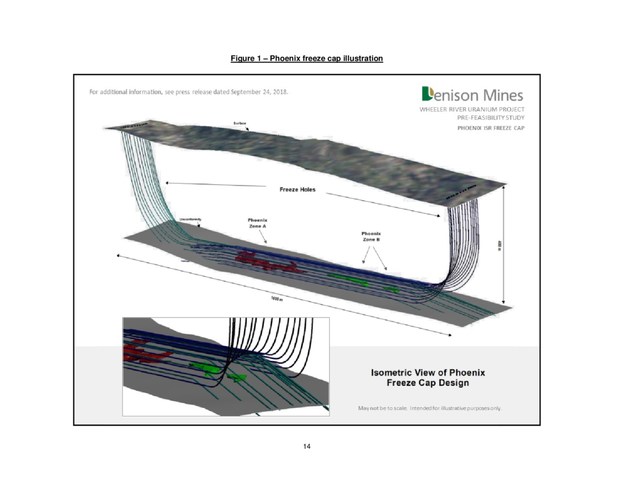

Processing of UBS

In certain conventional low-grade ISR operations, the concentration of uranium within the UBS recovered from the well field can range from 30 to 50 milligrams per litre (mg/L), which requires the use of ion exchange or solvent extraction processing circuits to concentrate the uranium and remove impurities for efficient precipitation processes. The volumes of UBS subject to processing are also typically quite large, due to the low-grade nature of the orebodies and the low level of uranium contained in the UBS recovered from the well fields.

As part of the PFS process, Denison completed numerous metallurgical test programs to simulate the ISR mining process, in accordance with industry standards – including leach tests, agitation leach tests, column tests, and post mining column restoration tests. All testing has indicated that the Phoenix ore is readily leached with a low pH (acid) solution, producing insignificant levels of impurities (i.e. arsenic, selenium) and very high levels of uranium recovery (98.5%).

Due to the high-grade nature of the Phoenix deposit, leach tests and column tests have consistently returned uranium concentrations within the UBS recovered from Phoenix samples between 12 and 20 grams per litre (g/L) – which is significantly higher than the level of uranium contained in the UBS recovered from certain conventional low-grade ISR well fields. At this level of concentration, much smaller volumes of UBS require processing in surface facilities. As a result of the high uranium concentration and low levels of impurities expected in the UBS, direct precipitation of the uranium is viable – which eliminates the need for ion exchange or solvent extraction circuits, and translates into reduced capital costs, reagent consumption, and operating costs during operations.

The PFS calls for the construction of a processing plant on the Wheeler River site, which has been designed to receive UBS from the well field with a uranium concentration of 10 grams per litre and with total throughput of 500 litres per minute. Taken together, this would allow for up to 6 million pounds U3O8 in annual production. The processing plant for Phoenix is designed as a closed loop system, meaning that once the uranium is precipitated from the UBS, the mining solution is reconditioned with reagents and returned to the wellfield for re-injection and further mining. The use of the freeze cap and simplified processing plant design eliminates the need for discharge of effluent during the process.

The simplified process flowsheet and processing plant design is based on the testing described above. There is risk that the Company may not be able to achieve estimated results or may require additional processing steps beyond those currently designed. This could have a material impact on project costs and economics.

See Figure 2 for Phoenix process plant flow sheet sketch

Well Field Design

Conventional ISR roll-front uranium deposits are typically spread out over several kilometers. The low-grade nature of these deposits combined with well spacing, reagent consumption, and surface piping and pumping distribution systems all contribute to create economic thresholds which impact the viability of some deposits. At Phoenix, the ore is confined to a relatively small area (~1 kilometre x 50 metres) and has proved readily leachable in laboratory testing. As a result, infrastructure costs (number of wells, extent of surface piping systems) and operating costs (reagent consumption) are expected to be significantly reduced when compared to conventional low-grade ISR operations – which are already generally regarded as the lowest cost uranium mining operations.

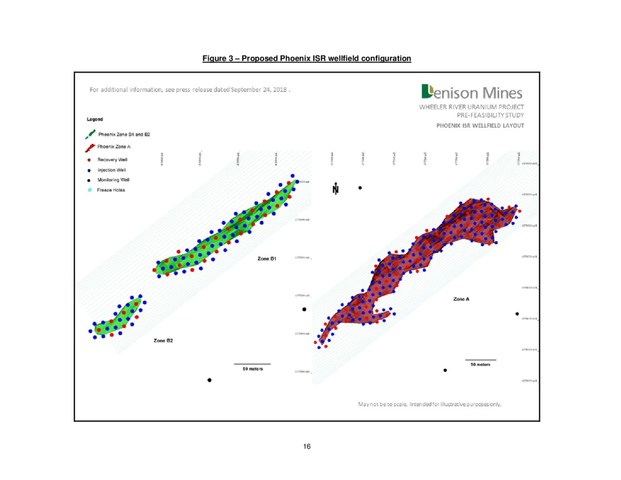

The well field design included in the PFS assumes the use of vertical recovery, injection, and monitoring wells, with a hexagonal pattern of injection wells surrounding each recovery well.

See Figure 3 for proposed Phoenix ISR well field configuration

Table 7 – Summary Phoenix ISR Wells | ||

Number of Wells | Drill Metres | |

Recovery Wells | 94 | 40,420 |

Injection Wells | 199 | 85,570 |

Monitoring Wells | 17 | 7,310 |

Total | 310 | 133,300 |

The Gryphon Operation

Overview

- Conventional underground mine amenable to low cost longhole stoping;

- Expected mine life of 6.5 years with annual average mine production of 7.6 million lbs U3O8;

- Estimated to have low operating costs (US$11.70/lb U3O8) – generating a relatively high operating margin at current uranium prices;

- Expectation to fund development by cash flow generated from the Phoenix operation, providing the Wheeler River project with further leverage to rising uranium prices

Table 8 – Gryphon Operation Summary of Economic Results | ||

Base Case | High Case | |

Uranium selling price | US$50/lb U3O8 | US$65/lb U3O8 |

Operating profit margin(1) | 77.0% | 82.3% |

Pre-tax NPV8%(2) | $560.6 million | $998.8 million |

Pre-tax IRR(2) | 23.2% | 31.0% |

Pre-tax payback period(3) | ~ 37 months | ~ 31 months |

(1) | Operating profit margin is calculated as aggregate uranium revenue less aggregate operating costs, divided by aggregate uranium revenue. Operating costs exclude all royalties, surcharges and income taxes; |

(2) | NPV and IRR are calculated to the start of pre-production activities for the Gryphon operation in 2026; |

(3) | Payback period is stated as number of months to pay-back from the start of uranium production. |

Table 9 – Gryphon Operating Cost per Pound U3O8 | ||

CDN$ | US$ | |

Mining | 5.46 | 4.20 |

Milling | 8.45 | 6.50 |

Transport to Converter | 0.21 | 0.16 |

Site support and administration | 1.09 | 0.84 |

Total Operating Costs per pound U3O8 | $15.21 | $11.70 |

Table 10 – Gryphon Capital Costs ($ millions) | |||

Initial | Sustaining | Total | |

Shafts | 131.5 | - | 131.5 |

Surface facilities | 46.9 | 6.1 | 53.0 |

Underground | 49.7 | 68.7 | 118.4 |

Utilities | 3.9 | 0.3 | 4.2 |

Electrical | 3.6 | - | 3.6 |

Civil & earthworks | 11.8 | 0.5 | 12.3 |

McClean Lake mill upgrades | 49.9 | - | 49.9 |

Offsite infrastructure | 32.4 | - | 32.4 |

Decommissioning | - | 1.6 | 1.6 |

Subtotal – Direct Costs | 329.7 | 77.2 | 406.9 |

Indirect costs | 142.0 | 5.1 | 147.1 |

Other (Owner's) costs | 28.1 | - | 28.1 |

Contingency | 123.3 | 0.4 | 123.7 |

Total Capital Costs (100%) | 623.1 | 82.7 | 705.8 |

Deposit & Geology

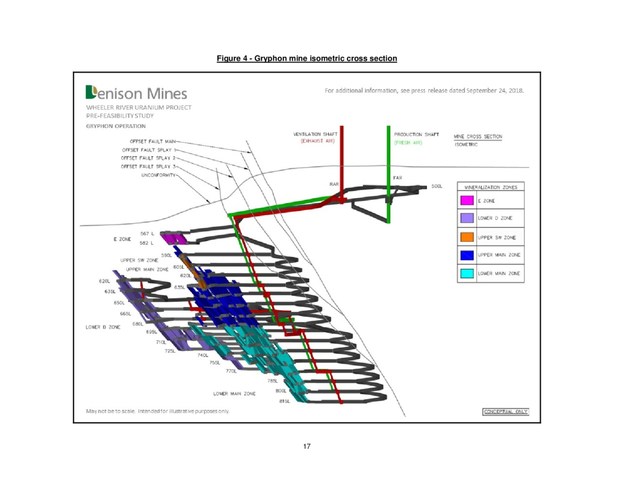

The Gryphon uranium deposit is located approximately three kilometres to the northwest of the Phoenix deposit and occurs 520 to 850 metres below surface dominantly within competent basement rocks. The Gryphon deposit has an overall strike length of 610 metres, dip length of 390 metres and variable thickness from 2 to 70 metres depending on the number of mineralized lenses present. The A, B and C series of lenses comprise of stacked, parallel lenses, which plunge to the northeast along a fault zone ("G-Fault") that occurs between the hanging wall graphite-rich pelitic gneisses and a more competent pegmatite-dominated footwall. The D series of lenses occur within the pegmatite-dominated footwall along a secondary fault zone ("Basal Fault") or within extensional relay faults which link to the G-Fault. The E series of lenses occur along the G-Fault, up-dip and along strike to the northeast of the A and B series lenses, within the upper basement or at the sub-Athabasca unconformity. Taken together, the Gryphon deposit, at a cut-off grade of 0.2% U3O8, is estimated to contain Indicated Mineral Resources of 1,643,000 tonnes, at a grade of 1.7% U3O8 for a total of 61.9 million pounds U3O8, plus Inferred Mineral Resources of 73,000 tonnes at a grade of 1.2% U3O8 for a total of 1.9 million pounds U3O8. For further details, see the Company's Resource Report, as filed on SEDAR and available on the Company's website. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Underground Mining via Longhole Stoping

The more moderate grades and style of mineralization within the basement rocks of the Gryphon deposit have allowed for the application of conventional underground mining methods, namely longitudinal retreat longhole stoping. The Gryphon deposit is centered ~270 metres below the unconformity, and the top of the planned mining horizon is situated ~25 metres below the unconformity, which is below the paleo weathering profile and is expected to provide a permanent pillar to separate the underground openings from the sandstone formations above. Engineering assessments support a 15 metre sub-level interval with the use of conventional remote-control equipment. Production is generally constrained by mill capacity and as a result the mine design calls for an average of ~600 tonnes per day production rate after a 2.5 year ramp-up period. The mineralization of the Gryphon deposit's A, B and C series of lenses, which occur largely together along the G-Fault, have been grouped together into the "Upper Main", "Lower Main" and "Upper SW" zones for mine planning purposes.

See Figure 4 for isometric cross section of Gryphon mine

Processing at 22.5% Denison Owned McClean Lake Mill

Production from the Gryphon operation is assumed to be processed at the 22.5% Denison owned McClean Lake processing plant, located in the northeastern portion of the Athabasca Basin region. The results of the metallurgical test work program completed for the PFS indicate that the Gryphon deposit is amenable to recovery utilizing the existing McClean Lake Mill flowsheet under current operating conditions, with an estimated recovery rate of 98.2%.

Due to the volume throughput expected from the Gryphon operation, the McClean Lake Mill will require certain upgrades, including expansion of the leaching circuit, the addition of a filtration system to complement the existing Counter Current Decantation (CCD) circuit, the installation of an additional tailings thickener, and an expansion of the acid plant. Various other small miscellaneous upgrades will also be required throughout the mill to achieve production at the licensed capacity of the facility (24 million pounds U3O8 per year). The McClean Lake Mill received a new 10 year operating license from the Canadian Nuclear Safety Commission in 2017 and is currently processing 100% of the mine production from the Cigar Lake mine under a toll milling agreement. The PFS assumes that Cigar Lake production will decline from 18 million pounds U3O8, at present, to approximately 15 million pounds U3O8 (when mining Phase 2 of the estimated resources) at the time of co-processing with ore from the Gryphon operation. In order to assess compatibility with Gryphon mill feed and to approximate the split of estimated mill operating costs, various assumptions have been made in regards to the nature and quantity of the mill feed from the Cigar Lake mine. Denison's interest in the McClean Lake joint venture ("MLJV") does not entitle the Company or the WRJV to process its mine production at the facility in the absence of a toll milling agreement. Accordingly, certain assumptions have been made regarding the likelihood and terms of a toll milling agreement with the MLJV. The estimated cost of production for Gryphon could be materially different should processing not be available at an existing local facility.

To facilitate access to the McClean Lake Mill from the Wheeler River site, the PFS also carries certain costs of building an extension to Highway 914 to connect the McArthur River and Cigar Lake operations, and allow for a more direct transport of Gryphon mine production to the McClean Lake mill over an approximately 160 kilometre route. Consultations with the Province of Saskatchewan have been encouraging in terms of participation in the project, as previously outlined on page 35 of the 2012 Saskatchewan Government document "Saskatchewan Plan for Growth – Vision 2020 and Beyond". The transportation of mine production comes with certain environmental risks, but similar operations in the region have long standing successful records of operating safely and with positive environmental performance.

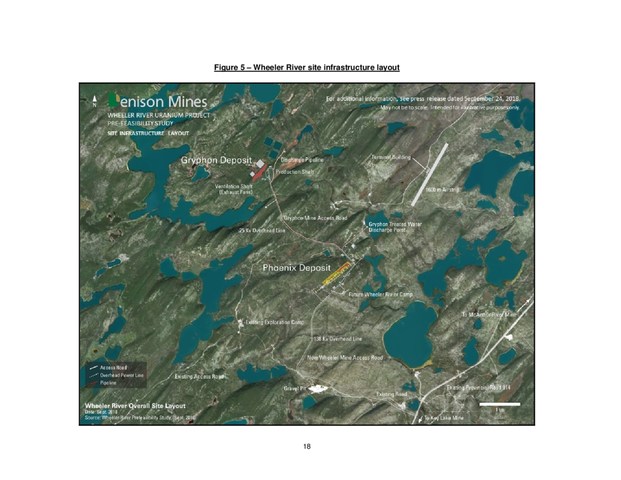

Site Infrastructure

The Wheeler River project is located near critical existing infrastructure in the eastern portion of the Athabasca Basin, including the Provincial power grid and Provincial Highway 914. Accordingly, the Wheeler River site is expected to be connected to both the Provincial power grid and road network with minimal effort. In the PFS, shared site infrastructure costs are generally included in the initial capital costs for the Phoenix operation, and include the following:

- Five kilometre site road connecting the Phoenix camp to Highway 914;

- Five kilometre site power line and associated fixturing connected to the Provincial power grid;

- Airstrip (1600 metres) to allow for transport of staff on a planned two week-in, two week-out basis;

- 150 person camp with kitchen and recreational facilities;

- Site operations centre including maintenance shop, offices, change house, and laboratories;

- Supplies warehousing and fuel storage facilities;

- Emergency / back-up power generators;

- Wash bay, scanning and weight scale facilities; and

- Potable and waste water treatment and waste storage facilities.

See Figure 5 for Wheeler River site infrastructure layout

Indicative Denison Post-Tax Results

The PFS is prepared on a pre-tax basis, as each partner to the WRJV is subject to different tax and other obligations. Denison has completed an indicative post-tax assessment based on a variety of its possible ownership interests – including its current ownership interest (63.3%), its expected ownership interest by the end of 2018 under the January 2017 dilution agreement (66.16%), and its expected ownership interest upon completion of the September 2018 agreement to acquire 100% of Cameco's interest in the WRJV (90%). Denison's indicative post-tax results also incorporate the impact of expected toll mill fees recovered from its 22.5% interest in the MLJV and the benefit of existing tax shelter balances.

Net Saskatchewan sales royalties consist of the resource surcharge (3%), and the basic uranium royalty (5%), which are partially offset by the resource credit (0.75%). These amounts are included in the pre-tax NPV calculations throughout the PFS; however, they are excluded from the operating cost per pound U3O8 metrics, as they vary with the value of assumed uranium sales. The profit from operations is subject to an additional Provincial uranium profit royalty, which is treated as an income tax, and allows for the use of certain tax shelter balances.

Certain scenarios representing Denison's post-tax indicative results for the Wheeler River project (including the Phoenix and Gryphon operations) are summarized below and are based on the prevailing Federal and Provincial taxation regulations in place at the time of the PFS.

Table 11 – Denison Indicative Post-Tax Results (Wheeler River) | ||

63.3% Denison | 90.0% Denison | |

Initial capital costs | $204.1 million | $290.3 million |

Base case post-tax IRR(1) | 31.8% | 32.7% |

Base case post-tax NPV8%(1) | $506.4 million | $755.9 million |

Base case post-tax payback period(2) | ~ 27 months | ~ 26 months |

High case post-tax IRR(1) | 53.9% | 55.7% |

High case post-tax NPV8%(1) | $1.01 billion | $1.48 billion |

High case post-tax payback period(2) | ~ 12 months | ~ 12 months |

(1) | NPV and IRR are calculated to the start of pre-production activities for the Phoenix operation in 2021. |

(2) | Payback period is stated as number of months to pay-back from the start of uranium production. |

Development Outlook

The results of the PFS demonstrate robust project economics – notably based on a uranium spot price forecast for the Phoenix deposit. This represents a comparatively conservative base case price assumption and supports the near-term advancement of the project towards the initiation of the Environmental Assessment ("EA") and permitting process, as well as the completion of a Feasibility Study ("FS").

To date, Denison has completed several years of environmental baseline studies and community consultations, as well as initial assessments for the Wheeler River project and its associated environmental interactions. The next step in the process is the submission of a Project Description to initiate the formal regulatory process through both the Federal and Provincial regulatory agencies. It is estimated that the EA approval process will require 3 to 4 years to complete, based on the regulations and process currently applicable.

Activities associated with the FS are expected to involve the confirmatory field and metallurgical testing for ISR operations at Phoenix, followed by the initiation of feasibility level engineering design work. Following completion of a positive FS and a decision to advance the project to the construction phase, detailed engineering and procurement activities would commence in preparation for construction to begin following receipt of all required regulatory approvals.

The PFS assumes that initial construction activities will commence in 2021 and that first production will be achieved from the Phoenix operation by mid-2024. Initial construction is expected to commence at Gryphon by 2026 and first production from Gryphon is expected to be achieved in 2030.

Qualified Persons

The disclosure of the results of the PFS contained in this news release, including the mineral reserves, was reviewed and approved by Peter Longo, P. Eng, MBA, PMP, Denison's Vice-President, Project Development, who is a Qualified Person in accordance with the requirements of NI 43-101.

The disclosure of a scientific or technical nature regarding the Phoenix and Gryphon deposits, including the mineral resources, contained in this news release was reviewed and approved by Dale Verran, MSc, P.Geo., Pr.Sci.Nat., Denison's Vice President, Exploration, who is a Qualified Person in accordance with the requirements of NI 43-101.

For a description of the data verification, assay procedures and the quality assurance program and quality control measures applied by Denison, please see Denison's Annual Information Form dated March 27, 2018 filed under the Company's profile on SEDAR at www.sedar.com.

About Denison

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. In addition to its 63.3% owned Wheeler River project, which ranks as the largest undeveloped high-grade uranium project in the infrastructure rich eastern portion of the Athabasca Basin region, Denison's Athabasca Basin exploration portfolio consists of numerous projects covering approximately 320,000 hectares. Denison's interests in the Athabasca Basin also include a 22.5% ownership interest in the McClean Lake joint venture ("MLJV"), which includes several uranium deposits and the McClean Lake uranium mill, which is currently processing ore from the Cigar Lake mine under a toll milling agreement, plus a 25.17% interest in the Midwest and Midwest A deposits, and a 65.45% interest in the J Zone deposit and Huskie discovery on the Waterbury Lake property. Each of Midwest, Midwest A, J Zone and Huskie are located within 20 kilometres of the McClean Lake mill.

Denison is also engaged in mine decommissioning and environmental services through its Denison Environmental Services division and is the manager of Uranium Participation Corp., a publicly traded company which invests in uranium oxide and uranium hexafluoride.

Cautionary Statement Regarding Forward-Looking Statements

Certain information contained in this press release constitutes "forward-looking information", within the meaning of the United States Private Securities Litigation Reform Act of 1995 and similar Canadian legislation concerning the business, operations and financial performance and condition of Denison.

Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes", or the negatives and / or variations of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur", "be achieved" or "has the potential to". In particular, this press release contains forward-looking information pertaining to the results of, and estimates, assumptions and projections provided in, the PFS, including future development methods and plans, market prices, costs and capital expenditures; the Company's current plans with respect to the commencement and completion of an EA and feasibility study on the project; assumptions regarding Denison's ability to obtain all necessary regulatory approvals to commence development; Denison's percentage interest in its projects and its agreements with its joint venture partners; and the availability of services to be provided by third parties. Statements relating to "mineral resources" are deemed to be forward-looking information, as they involve the implied assessment, based on certain estimates and assumptions that the mineral resources described can be profitably produced in the future.

Forward looking statements are based on the opinions and estimates of management as of the date such statements are made, and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those expressed or implied by such forward-looking statements. Denison faces certain risks, including the inability to permit or develop the project as currently planned, the unpredictability of market prices, the use of mining methods which are novel and untested in the Athabasca Basin, events that could materially increase costs, changes in the regulatory environment governing the project lands, and unanticipated claims against title and rights to the project. Denison believes that the expectations reflected in this forward-looking information are reasonable but there can be no assurance that such statements will prove to be accurate and may differ materially from those anticipated in this forward looking information. For a discussion in respect of risks and other factors that could influence forward-looking events, please refer to the "Risk Factors" in Denison's Annual Information Form dated March 27, 2018 available under its profile at www.sedar.com and its Form 40-F available at www.sec.gov/edgar.shtml. These factors are not, and should not be construed as being exhaustive.

Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking information contained in this press release is expressly qualified by this cautionary statement. Any forward-looking information and the assumptions made with respect thereto speaks only as of the date of this press release. Denison does not undertake any obligation to publicly update or revise any forward-looking information after the date of this press release to conform such information to actual results or to changes in its expectations except as otherwise required by applicable legislation.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources: This press release may use the terms "measured", "indicated" and "inferred" mineral resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. "Inferred mineral resources" have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists, or is economically or legally mineable.

SOURCE Denison Mines Corp.