Projects

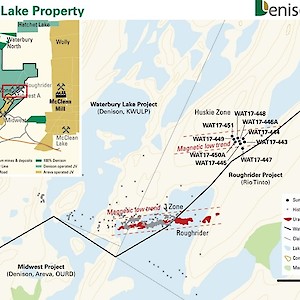

Waterbury Project

Waterbury

As we continue to advance this exciting project we will post the latest maps and photos. Click icons to view.

Project Highlights

Host to the Tthe Heldeth Túé (formerly J Zone) and Huskie uranium deposits.

Denison has completed an independent Preliminary Economic Assessment (“PEA”) for the Waterbury Lake Property evaluating the potential use of the In-Situ Recovery “ISR” mining method at the Tthe Heldeth Túé (“THT”) deposit with processing at Denison’s 22.5% owned McClean Lake mill.

The PEA demonstrates robust economics for a small-scale Athabasca Basin ISR uranium mining project – including low initial capital costs, low operating costs and globally competitive all-in costs. (See press release Nov 2020).

Preliminary Economic Assessment Highlights (see below for details):

- Selection of ISR mining method potentially unlocks the value of the THT deposit

- Freeze Wall design expected to reduce technical risk and upfront capital costs

- Existing regional infrastructure offers significant benefit

- Potential to be one of the most environmentally responsible mining operations in the world

The information on this page is from the November 17, 2020 news release reporting the results from the 2020 Waterbury Preliminary Economic Assessment filed on December 30, 2020.

The PEA is available in link: Waterbury PEA December 2020

Tthe Heldeth Túé

The Ya’thi Néné Land and Resource Office working together with Denison, reviewed the Conceptual Mining Study prepared by Denison for the J Zone deposit prior to initiation of the PEA (see news release dated July 28, 2020). The YNLR provided valuable early feedback related to the Project’s next steps, and recommended the use of a Dené name for the deposit that would recognize and respect the connection of the Athabasca Denesųłiné to the land where the deposit is located: the “Tthe Heldeth Túé” deposit – pronounced “Tey Hel-deth Tway”.

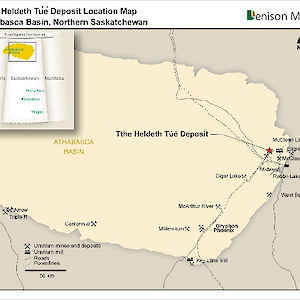

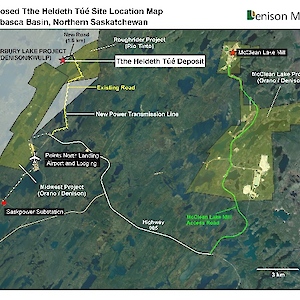

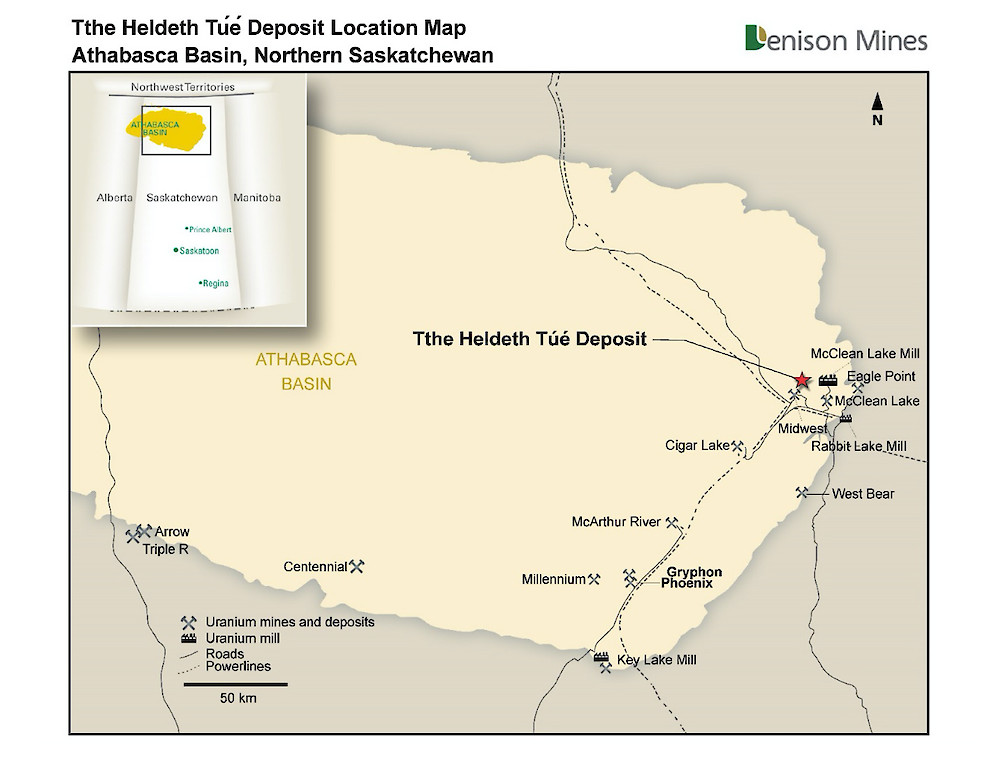

Location

The Waterbury Lake property is located within the eastern part of the Athabasca Basin in Northern Saskatchewan. The property can be accessed year-round by provincial highway to Points North Landing, a privately owned service centre with accommodations and an airfield, which is located near the eastern edge of the property. Several uranium mills and mines are located close to the deposit.

Ownership

Waterbury is owned by the Waterbury Lake Uranium Limited Partnership (“WLULP”), of which Denison Waterbury Corp. (a wholly-owned subsidiary of Denison) owns 70.32% and Korea Waterbury Lake Uranium Limited Partnership (“KWULP”) owns 29.68% (as of December 31, 2024). KWULP is comprised of a consortium of investors, in which Korea Hydro & Nuclear Power (“KHNP”) holds a majority position. KHNP is headquartered in Gyeongju, South Korea and is the country’s largest electrical power generation company. KHNP is also a significant shareholder in Denison.

Preliminary Economic Analysis

Waterbury PEA Financial Results (100% Basis)

The technical report, prepared in accordance with 43-101, was completed in 2020. The highlights of the PEA are:

| Mine life | ~ 6 years (Avg. ~1.6 million lbs U3O8 per year) |

| Projected mine production (1) | 9.7 million lbs U3O8 (177,664 tonnes at 2.49%) |

| Average cash operating costs | USD$12.23 ($16.27) per lb U3O8 |

| Initial capital costs (2) | $112 million |

| Base case pre-tax IRR (3) | 39.1% |

| Base case pre-tax NPV8% (3) | $177 million |

| Base case price assumption | UxC spot price(4) (Avg. USD$53.59 per lb U3O8) |

| Operating profit margin (5) | 77% at USD$53.59 per lb U3O8 |

| All-in cost (6) | USD$24.93 ($33.16) per lb U3O8 |

- Projected mine production uses an 85% ISR recovery factor and excludes sterilized and unavailable areas of the THT deposit.

- Initial capital costs exclude $20.1 million of estimated pre-construction Project evaluation and development costs.

- NPV and IRR are calculated to the start of pre-production activities for the THT operation in 2025.

- Spot price forecast is based on “Composite Midpoint” scenario from UxC’s Q3’2020 Uranium Market Outlook (“UMO”) for the years 2028 to 2033, and is stated in constant (not-inflated) dollars.

- Operating profit margin is calculated as uranium revenue less operating costs, divided by uranium revenue. Operating costs exclude all royalties, surcharges and income taxes.

- All-in cost is estimated on a pre-tax basis and includes all project operating costs and capital costs, excluding project evaluation and development costs, divided by the estimated number of pounds U3O8 to be produced at the mill.

The PEA is preliminary in nature shall not be considered as a Pre-Feasibility or Feasibility Study. It includes indicated mineral resources and ISR mining recovery factor that are considered too speculative geologically to have the economic considerations applied to them to be categorized as mineral reserves, and there is no certainty that the preliminary economic assessment will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Preliminary Economic Assessment Highlights:

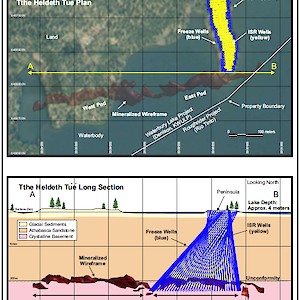

- Selection of ISR mining method potentially unlocks the value of the THT deposit: Following the release of the Wheeler PFS in 2018 and subsequent studies aimed at increasing confidence in the ISR mining method for the Phoenix deposit, including the achievement of “proof of concept” (see Denison’s news release dated June 4, 2020), Denison evaluated the application of the ISR mining method on the THT deposit. Similar to Phoenix, the THT deposit is an unconformity-related uranium deposit, where the mineralization is interpreted to be situated in permeable ground – expected to allow a mining solution to travel within the mineralized zone. Additionally, the basement rock located below the mineralized zone is interpreted to be highly impermeable and is expected to allow for containment of the mining solution beneath the deposit.

- Freeze Wall design expected to reduce technical risk and upfront capital costs: Full hydraulic containment of the orebody during mining activities has been planned for the Project with the installation of a freeze wall from surface to the basement rocks underlying the THT deposit– effectively creating containment 360 degrees around the deposit. This design makes use of established ground-freezing technology and conventional diamond drilling to create a physical perimeter around the deposit – containing the mining solution used in the ISR mining process and protecting the surrounding environment to minimize environmental impacts of the Project. Several additional containment methodologies were evaluated as part of the Concept Study – including the freeze dome design outlined in the Wheeler PFS. Results of the Concept Study showed that the freeze wall design offered considerably lower technical risk, equal or greater environmental protection, a smaller environmental footprint, sustainability benefits associated with the utilization of drilling techniques conducive to local employment, and improved economic results with significantly lower initial capital costs.

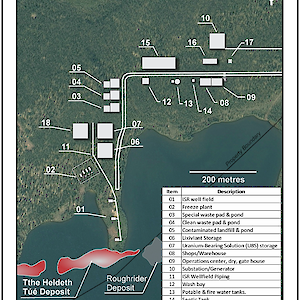

- Existing regional infrastructure offers significant benefit: The Waterbury Lake property is located approximately 15 kilometres from Denison’s 22.5% owned McClean Lake uranium mill, in the infrastructure rich eastern portion of the Athabasca Basin region. The PEA assumes the McClean Lake uranium mill will be used to process the Uranium Bearing Solution (“UBS”) to be recovered from the ISR wellfield and the nearby Points North Landing (“Points North”) facilities will be used for accommodations and other support services. Taken together, this existing regional infrastructure results in a significant reduction in the initial capital costs and operating costs estimated in the PEA.

- Potential to be one of the most environmentally responsible mining operations in the world: The combination of the ISR mining method with a high-grade uranium deposit in the Athabasca Basin region has the potential to result in one of the most environmentally protective mining operations in the world – owing to the small foot print of the operation and its minimal surface disturbances, as well as the fact that there are no tailings expected to be generated and no site water discharge planned. The modelled operation also has access to the Provincial power grid and is not expected to rely on diesel generators for primary power on site. Additionally, the freeze wall design provides for the physical isolation of the ISR mining operation from the surrounding environment, which alleviates the primary environmental concern of conventional ISR mining operations and facilitates a controlled restoration process once mining has been completed.

Price Assumptions & Sensitivities

The base-case economic analysis assumes uranium sales will be made from time to time throughout production at UxC’s forecasted annual “Composite Midpoint” spot price from the Q3’2020 Uranium Market Outlook (“UMO”), which is stated annually in constant (non-inflated) 2020 dollars and ranges from ~USD$49 per lb U3O8 to USD$57 per lb U3O8 during the approximate six year estimated life of the THT operation (assumed for pricing purposes to be from 2028 to 2033). The average base case selling price is USD$53.59 per lb U3O8.

Given the estimated all-in costs of USD$24.93 per lb U3O8, the Project is projected to be able to generate positive economic results at uranium selling prices in the range of recent market conditions, while also offering excellent leverage to a rising uranium price, as outlined below:

| Table 4 – Sensitivity of Waterbury to Uranium Pricing Scenarios (100% Basis) | |||

|

|

Low Case |

Base case |

High Case |

|

Uranium price |

USD$35 per lb U3O8 |

UxC spot price (3) |

USD$65 per lb U3O8 |

|

Pre-tax NPV8% (1) |

$38 million |

$ 177 million |

$ 265 million |

|

Pre-tax IRR (1) |

17.4% |

39.1% |

50.0% |

|

Pre-tax payback period (2) |

~33 months |

~22 months |

~18 months |

- NPV and IRR are calculated to the start of pre-production activities for the Project.

- Payback period is stated as number of months to pay-back from the start of uranium production.

- Spot price forecast is based on “Composite Midpoint” scenario from UxC’s Q3’2020 Uranium Market Outlook (“UMO”) for the years 2028 to 2033 and is stated in constant (not-inflated) dollars.

Indicative Denison Post-Tax Results

The PEA is prepared on a pre-tax and 100% ownership basis, as each partner to the WLULP is subject to different tax and other obligations. Denison has completed an indicative post-tax assessment that reflects its ownership interest in the WLULP (66.90%), the impact of expected toll mill fees recovered from its 22.5% interest in the MLJV, and the benefit of Denison’s applicable existing tax shelter balances.

Net Saskatchewan sales royalties consist of the resource surcharge (3%), and the basic uranium royalty (5%), which is partially offset by the resource credit (0.75%). These amounts are included in the pre-tax NPV calculations throughout the PEA; however, they are excluded from the U3O8 operating cost per pound metrics, as they vary with the value of assumed uranium sales. The profit from operations is subject to an additional Provincial uranium profit royalty, which is treated as an income tax, and allows for the use of certain tax shelter balances.

Denison’s post-tax indicative results for the THT project are summarized below and are based on the prevailing Federal and Provincial taxation regulations in place at the time of the PEA as well as Denison’s 66.90% ownership of the property as of the end of November 2020.

| Table 9 – Denison Indicative Post-Tax Results (66.90% ownership) | |

| Initial capital costs – Denison Share (1) | $75 million |

| Base case post-tax IRR (2) | 30.4% |

| Base case post-tax NPV8% (2) | $72 million |

| Base case post-tax payback period (3) | ~ 23 months |

| High case post-tax IRR (2) | 38.9% |

| High case post-tax NPV8% (2) | $109 million |

| High case post-tax payback period (3) | ~19 months |

| Low case post-tax IRR (2) | 13.5% |

| Low case post-tax NPV8% (2) | $14 million |

| Low case post-tax payback period (1) | ~34 months |

- Initial capital cost excludes estimated pre-construction Project evaluation and development costs

- NPV and IRR are calculated to the start of pre-production activities for the THT operation.

- Payback period is stated as number of months to pay-back from the start of uranium production.

The PEA is preliminary in nature and should not be considered the same as a Pre-Feasibility or Feasibility Study, as various factors are considered too speculative to have the economic considerations applied to them to be categorized as mineral reserves. There is no certainty that the results from the PEA will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Estimated Mineral Resources

| Deposit |

Classification |

Tonnes |

Grade % U3O8 |

1000 Lbs U3O8 |

|

Tthe Heldeth Túé |

Indicated |

291,000 |

2.00 |

12,810 |

|

Huskie |

Inferred |

268,000 |

0.96 |

5,687 |

Notes:

- Mineral resources are not mineral reserves and have not demonstrated economic viability. All figures have been rounded to reflect the relative accuracy of the estimates.

- The Tthe Heldeth Túé Mineral Resource estimate was prepared for the Company by GeoVector Management Inc. in accordance with CIM Definition Standards (2005) and NI 43-101 with an effective date of September 6, 2013.

- The audited Mineral Resource Statement for the Huskie deposit was prepared by Dr. Oy Leuangthong, PEng and Mr. Cliff Revering of SRK Consulting (Canada) Inc. with an effective date of October 17, 2018.

- Mineral resources for the THT deposit are reported above a cut-off grade of 0.1% U3O8.

- Mineral resources for the Huskie deposit are reported above a cut-off grade of 0.1% U3O8.

References

“Preliminary Economic Assessment for the The Heldeth Túé (J Zone) Deposit, Waterbury Lake Property, Northern Saskatchewan, Canada" dated December 23, 2020.

The technical information has been reviewed and approved by a Qualified Person in accordance with the requirements of NI 43-101.