Projects

Wheeler River – Gryphon Deposit

Gryphon Deposit

Detailed

Maps

New Maps Coming Soon.

Recent

Photos

New Photos Coming Soon.

Drone

Video

Drone Video

Drone Video Pending.

Featured

Video

Featured Video

Featured Video Pending.

Project Highlights

Effective 2023, Denison completed a cost update to the 2018 Pre-Feasibility Study for conventional underground mining of the basement-hosted Gryphon uranium deposit (“Gryphon Update”).

Gryphon Update Highlights

- Scope of Gryphon Update was targeted at the review and update of capital and operating costs – mining and processing plans remaining largely unchanged from the 2018 PFS aside from minor scheduling and construction sequencing optimizations.

- Base case pre-tax NPV (8%) of $1.43 billion (100% basis), is a 148% increase in the base-case pre-tax NPV8% for Gryphon from the 2018 PFS.

- Strong base-case pre-tax IRR of 41.4%.

- Base-case after-tax NPV8% of $864.2 million (100% basis) and IRR of 37.6% – with Denison’s effective 95% interest in the project equating to a base-case after-tax NPV8% of $821.0 million.

- Base-case pre-tax payback period of 20 months, and base-case after-tax payback period of 22 months – equating to a reduction of 17 months for the pre-tax payback period from the 2018 PFS.

- Project remains to be positioned amongst the lowest-cost uranium mines in the world and provides Denison with an additional source of low-cost potential production to deploy significant free cash flows expected from Phoenix.

Gryphon Underground Pre-Feasibility Study Update

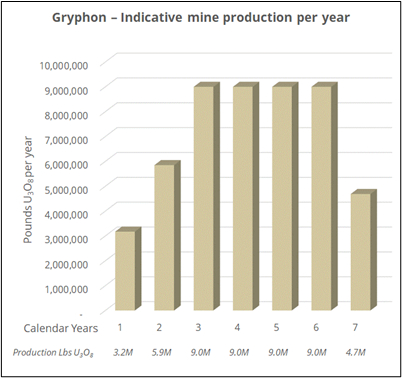

The 2018 PFS and the Gryphon Update describe the planned development of Gryphon as a conventional underground mine with a mine life of 6.5 years and annual average mine production of 7.6 million pounds U3O8. The Gryphon Update was prepared by Engcomp Engineering and Computing Professionals Inc. (“Engcomp”), SLR International Corporation (“SLR”), Stantec Consulting Ltd. (“Stantec”), and Hatch Ltd. (“Hatch”), and is largely based on the 2018 PFS, with efforts targeted at the review and update of capital and operating costs, as well as various minor scheduling and design optimizations. The study remains at the Pre-Feasibility ("PFS") level of confidence.

Overall, the Gryphon Update demonstrates that the underground development of Gryphon is a positive potential future use of cash flows generated from Phoenix, as it is able to leverage existing infrastructure to provide an additional source of low-cost production.

|

Table 9 – Summary of Key Gryphon Operation Parameters (100% Basis) |

|

|

Mine life |

6.5 years |

|

Probable reserves(1) |

49.7 million lbs U3O8(1,275,000 tonnes at 1.8% U3O8) |

|

Average annual production |

7.6 million lbs U3O8 |

|

Initial capital costs(2) |

$737.4 million |

|

Average cash operating costs |

$17.27 (USD$12.75) per lb U3O8 |

|

All-in cost(3) |

$34.50 (USD$25.47) per lb U3O8 |

- See below for additional information regarding Probable reserves.

- Initial capital costs exclude $56.5 million in pre-construction expenditures expected to be incurred prior to making a final investment decision (“FID”).

- All-in cost is estimated on a pre-tax basis and includes all project operating costs, capital costs post-FID, and decommissioning costs, divided by the estimated number of pounds U3O8 to be produced

|

Table 10 – Summary of Gryphon Economic Results (100% Basis) |

||

|

Base Case |

PFS Ref. Case(1) |

|

|

Uranium selling price |

USD$75/lb U3O8(2) (Fixed selling price) |

USD$65/lb U3O8 (Fixed selling price) |

|

Exchange Rate (USD$:CDN$) |

1.35 |

1.30 |

|

Discount Rate |

8% |

8% |

|

Operating profit margin(3) |

83.0% |

79.6% |

|

Pre-tax NPV8%(4) (Change from 2018 PFS)(7) |

$1.43 billion (+148%) |

$1.00 billion (-5%) |

|

Pre-tax IRR(4) |

41.4% |

34.0% |

|

Pre-tax payback period(6) |

~ 20 months |

~ 24 months |

|

Post-tax NPV8%(4)(5) |

$864.2 million |

$599.9 million |

|

Post-tax IRR(4)(5) |

37.6% |

30.6% |

|

Post-tax payback period(5)(6) |

~23 months |

~ 26 months |

- The “PFS Reference Case” economic analysis reflects the outcome of the current Phoenix FS based on a uranium selling price that is the same as the “High Case” previously reported from the 2018 PFS, which was based on a fixed uranium selling price of USD$65 per pound U3O8 and a US to Canadian dollar exchange rate of 1.3 to 1. This case allows for a direct comparison of the NPV outcome from the Phoenix FS to the 2018 PFS.

- Fixed selling price is based on the forecasted annual “composite Midpoint” long-term uranium price from UxC’s Q2’2023 UMO and is stated in constant (not-inflated) dollars, see details below.

- Operating profit margin is calculated as aggregate uranium revenue less aggregate operating costs, divided by aggregate uranium revenue. Operating costs exclude all royalties, surcharges and income taxes.

- NPV and IRR are calculated to the start of construction activities for the Gryphon operation, and excludes $5 million in pre-FID expenditures.

- Post-tax NPV, IRR and payback period for Gryphon are the same on a “Basic” and “Adjusted” basis, as entity level tax attributes are assumed to have been fully depleted by the Phoenix operation.

- Payback period is stated as number of months to payback from the start of uranium production.

- Change from 2018 PFS is computed by reference to the same scenario from the 2018 PFS, as discussed below, adjusted to incorporate certain pre-FID costs for consistent comparability.

Mineral Resource Estimate

The mineral resource estimate for Gryphon remains unchanged from the 2018 PFS. Using a cut-off grade of 0.2% U3O8, Gryphon is estimated to contain Indicated mineral resources of 1,643,000 tonnes, at a grade of 1.7% U3O8 for a total of 61.9 million pounds U3O8, plus Inferred mineral resources of 73,000 tonnes at a grade of 1.2% U3O8 for a total of 1.9 million pounds U3O8.

Mineral resources are stated inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Mining Overview & Mineral Reserve Estimate

The mine development and production plan for Gryphon remains largely the same as the 2018 PFS. Access to the deposit is planned to be via a primary production shaft with a diameter of 6.1 metres, installed using a blind boring method to a depth of 550 metres below surface. A ventilation shaft with a diameter of 5.8 metres, is also planned to be excavated via blind boring to a depth of 550 metres. Both shafts will be lined with a watertight steel/concrete composite liner.

Access from the shaft to the mine workings will be via a single ramp located on the hanging wall of the deposit. Mining is planned to consist of conventional underground longhole stoping mining methods, and is expected to primarily utilize a longitudinal retreat approach. Mined stopes will be backfilled using a combination of rockfill, cemented rockfill, and hydraulic fill.

Mining is expected to produce approximately 605 tonnes per day of ore and an average of 330 tonnes per day of waste rock during the steady-state operating period. While the mine has the potential to exceed this rate of production, the study constrains mine production based on expected processing capacity of 9 million pounds U3O8 per year (as discussed below).

The project development and construction schedule was reviewed during the completion of the Gryphon Update, and minor capital and scheduling efficiencies were found to allow for the deferral of some construction activities without an impact to the overall project schedule. These modifications have been reflected in timing of anticipated expenditures for Gryphon.

Overall, 49.7 million pounds U3O8 over 1,260,000 tonnes grading 1.8% U3O8 are planned to be extracted from Gryphon over an approximately 6.5-year mine life.

|

Table 11 – Gryphon Mineral Reserves (100% Basis) |

|||

|

Confidence Category |

Tonnes |

Grade |

Million lbs U3O8 |

|

Probable |

1,257,000 |

1.8 |

49.7 |

|

TOTAL |

1,257,000 |

1.8 |

49.7 |

- The effective date of the mineral reserve estimate is Sept 1 2018. The QP for the estimate is Mr. Mark Hatton, P.Eng., an employee of Stantec.

- The mineral reserve estimate was prepared in accordance with the CIM Definition Standards (CIM, 2014).

- Mineral Reserves are stated at a processing plant feed reference point.

- Mineral Reserves for the Gryphon deposit are estimated at a cut-off grade of 0.58% U3O8 based on longhole mining using a long-term uranium price of USD$50/lb and a USD$/CA$ exchange rate of 0.80. The mineral reserves are based on a mine operating cost of $150/t, mil operating cost of $275/t, G&A cost of $99/t, transportation cost of $50/t, milling recovery of 97%, and 7.25% fee for Saskatchewan royalties. Mineral reserves estimates account for diluting material and mining losses.

Processing Overview

Consistent with the 2018 PFS, production from the Gryphon operation is assumed to be processed at the 22.5% Denison-owned McClean Lake processing plant, which is located in the northeastern portion of the Athabasca Basin region. The results from the 2018 PFS indicate that the Gryphon deposit is amenable to recovery utilizing the existing flowsheet for the McClean Lake mill with minimal required upgrades and an estimated recovery rate of 98.2%.

The McClean Lake mill received a 10-year operating license from the CNSC in 2017 and is currently processing 100% of the mine production from the Cigar Lake mine under a toll milling agreement. Additionally, in early 2022, the McClean Lake operation was granted the final approval needed to amend its license to allow for an expansion of the tailings management facility on site.

Due to the volume of throughput expected from the Gryphon operation, the McClean Lake mill will require certain upgrades to process the mine production from Gryphon. Various other small upgrades are also expected to be required to achieve production at the licensed annual capacity of 24 million pounds U3O8. The study assumes that Cigar Lake production will decline from 18 million pounds U3O8, at present, to approximately 15 million pounds U3O8 at the time of co-processing with ore from the Gryphon operation. In order to assess compatibility with Gryphon mill feed and to approximate the split of estimated mill operating costs, various assumptions have been made in regard to the nature and quantity of the mill feed from the Cigar Lake mine. Denison's interest in the McClean Lake Joint Venture ("MLJV") does not entitle the Company or the WRJV to process its mine production at the facility in the absence of a toll milling agreement. Accordingly, certain further assumptions have been made regarding the likelihood and terms of a toll milling agreement with the MLJV. The estimated cost of production for Gryphon could be materially different should processing not be available at an existing local facility.

To facilitate access to the McClean Lake mill from the Wheeler River site, the Gryphon Update carries certain costs of building an extension to Highway 914 to connect the McArthur River and Cigar Lake operations and to allow for the transport of Gryphon mine production over an approximately 160 kilometre route.

Site Infrastructure

Due to its proximity to Phoenix, the Gryphon operation is expected to benefit from site infrastructure that is planned to be established in support of the Phoenix ISR mine (e.g., airstrip, camp, access road, power distribution). Additional site infrastructure for Gryphon is generally limited to items directly related to the underground mining operation, including incremental power distribution requirements, ore and waste rock handling, as well as mine water handling and treatment.

Capital Costs

Initial capital costs are expected to be incurred during a 42-month construction period that will include approximately 24 months for the completion of the production shaft and vent raise. Surface facilities, underground excavation, haulage road, and McClean Lake mill upgrades are expected to take approximately 18 months. Initial ore recovery occurs prior to the completion of construction and ramps up for the mine to achieve full production by year 3.

|

Table 12 – Gryphon Capital Costs ($ millions) |

|||

|

Initial |

Sustaining |

Total |

|

|

Shafts |

222.4 |

- |

222.4 |

|

Surface facilities |

63.0 |

7.5 |

70.5 |

|

Underground |

63.9 |

86.2 |

150.1 |

|

Utilities |

5.3 |

- |

5.3 |

|

Electrical |

5.4 |

- |

5.4 |

|

Civil & earthworks |

16.0 |

- |

16.0 |

|

McClean Lake mill upgrades |

67.9 |

- |

67.9 |

|

Offsite infrastructure |

43.7 |

- |

43.7 |

|

Decommissioning |

- |

5.0 |

5.0 |

|

Subtotal – Direct Costs |

487.6 |

98.7 |

586.3 |

|

Indirect costs |

76.5 |

5.0 |

81.5 |

|

Other (Owner’s) costs |

25.6 |

- |

25.6 |

|

Contingency |

147.7 |

- |

147.7 |

|

Total Capital Costs (100%) |

737.4 |

103.7 |

841.1 |

- Numbers may not add due to rounding.

Contingencies reflect approximately 25% of total capital costs, which is considered appropriate given the estimate was prepared to meet AACE Class 4 requirements in alignment with the stage of engineering and design efforts for the project.

Operating Costs

Estimated operating costs of $17.27 (USD$12.75) per pound U3O8 produced remain highly competitive amongst the lowest-cost uranium mining operations globally.

|

Table 13 – Gryphon Operating Cost per Pound U3O8 |

||

|

CAD$ |

USD$ |

|

|

Mining |

6.85 |

5.05 |

|

Milling |

8.76 |

6.47 |

|

Transport to Converter |

0.27 |

0.20 |

|

Site support and administration |

1.40 |

1.03 |

|

Total Operating Costs per pound U3O8 |

$17.27 |

$12.75 |

- Numbers may not add due to rounding.

Uranium Selling Price Assumptions

The base-case economic analysis assumes uranium sales from Gryphon mine production will be made throughout the mine life at a fixed price of USD$75 per pound U3O8, which is based on the average of the forecasted annual “Composite Midpoint” long-term uranium price from UxC’s Q2’2023 UMO, which is stated in constant (non-inflated) 2023 dollars, during the indicative production period of Gryphon to the nearest USD$5 per pound U3O8. This is the same pricing methodology applied for Gryphon as the base-case scenario in the 2018 PFS, where the “composite Midpoint” long-term uranium price during the indicative years of production averaged ~USD$50 per pound U3O8 in then constant 2018 dollars. Consistent with the 2018 PFS, the overall cost profile and construction timeline of the planned Gryphon underground mine is considered to be more amenable to fixed (base escalated) price contracts with nuclear energy utilities to reduce risk and justify a development decision. Accordingly, the long-term price indicator from UxC has been used for the Gryphon base-case economic analysis.

The PFS reference case economic analysis reflects the outcome of the current Gryphon Update based on a uranium selling price that the same as the “High Case” previously reported from the 2018 PFS, which was based on a fixed uranium selling price of USD$65 per pound U3O8 and a US to Canadian dollar exchange rate of 1.3 to 1. This case allows for a direct comparison of the NPV outcome from the Gryphon Update to the 2018 PFS.

Post-Tax Economic Analysis

The Gryphon Update only considers one post-tax scenario for the project’s base-case economic analysis, as the there is no basis for an “adjusted” case, given that the entity level tax attributes of the WRJV owners are assumed to have been fully depleted by the Phoenix operation. In calculating the profit royalties and Canadian federal and provincial taxes payable for the Gryphon Update, it has been assumed that the Gryphon construction period will occur at a time when it will be allowable to deduct the pre-production expenditures against income from Phoenix that is not otherwise sheltered, thus the cash flow benefit of those deductions have been reflected prior to first production from Gryphon.

Permitting and Development Plans

At this time, Denison has not made a decision to advance Gryphon. While the project may benefit from certain infrastructure associated with the development of Phoenix, Gryphon is currently considered a stand-alone project. Gryphon is not expected to be subject to a Federal EA, as it would not meet the criteria of a designated activity as contemplated by the Physical Activities Regulations under the Impact Assessment Act (“IAA”), which replaced CEAA 2012 for projects commencing the regulatory review process after August 28, 2019.. If advanced into the permitting process, Gryphon will, however, remain subject to the requirement to complete an EA under the Saskatchewan Environmental Assessment Act, and will require (i) licensing by the CNSC and (ii) permitting by the Saskatchewan Ministry of Environment. The required licenses and permits cannot be issued until a decision on the Provincial EA has been made.

Opportunities

The Gryphon Update remains at the PFS level of confidence, and opportunities remain to complete additional studies to further advance confidence in the project plans. There are notable opportunities for optimization of the Gryphon mine design, including: (i) additional exploration drilling may increase estimated mineral resources, which with further studies could increase available probable reserves to support an extended mine life; (ii) increasing the shaft depth could improve the ramp up schedule of the mine and allow for earlier production; (iii) selecting a conventional method of shaft sinking by reusing ground freezing equipment potentially available from the Phoenix operation could improve schedule and reduce risks associated with blind boring; (iv) radiometric ore sorting underground could significantly reduce the quantity of ore to be transported to the mill for processing and could result in material reductions in transportation costs, milling costs, and (v) the addition of a grinding and leaching circuit at Gryphon to produce UBS to feed the processing plant proposed for the Phoenix operation, potentially reducing offsite infrastructure operating and capital costs associated with the upgrades needed for the McClean lake mill and the extension of Highway 914.

References & Reports

For more information, see the press release dated June 26, 2023 and the “NI 43-101 Technical Report on the Wheeler River Project, Athabasca Basin, Saskatchewan, Canada” dated August 8, 2023 with an effective date of June 23, 2023.

The technical information has been reviewed and approved by Mr. Chad Sorba, P.Geo, Denison’s Vice President Technical Services & Project Evaluation, a Qualified Person in accordance with the requirements of NI 43-101.