Projects

Wheeler River Project

Wheeler River

Phoenix In-Situ Recovery Uranium Project & Gryphon Underground Uranium Project

Project Highlights

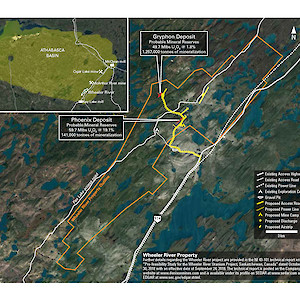

PROJECT DESCRIPTION & LOCATION

Wheeler River is the largest undeveloped uranium project in the eastern portion of the Athabasca Basin region in northern Saskatchewan, Canada. The project hosts two high-grade uranium deposits: Phoenix and Gryphon.

The project is situated in close proximity to important regional infrastructure, including the Provincial electrical transmission grid and an all-season Provincial highway.

PHOENIX FEASIBILITY STUDY

Effective 2023, Denison completed the Feasibility Study for In-Situ Recovery “ISR” mining of the high-grade Phoenix uranium deposit.

Click here, for a summary extract of the Phoenix Feasibility Study.

GRYPHON UPDATED PRE-FEASIBILITY STUDY

Effective 2023, Denison completed a cost update to the 2018 Pre-Feasibility Study (“2018 PFS”) for conventional underground mining of the basement-hosted Gryphon uranium deposit (“Gryphon Update”).

Click here, for a summary extract of the Gryphon Update.

More Information

For more information regarding the Phoenix FS and Gryphon Update, see:

Location

The property is located along the eastern edge of the Athabasca Basin in northern Saskatchewan, Canada and is located approximately 35 kilometres northeast of the Key Lake mill and 35 kilometres southwest of the McArthur River uranium mine. The property is well located with respect to all-weather roads and the provincial power grid. Vehicle access to the property is by the provincial highway system to the Key Lake mill then by the ore haul road between the Key Lake and McArthur River operations to the eastern part of the property.

Ownership

The project is a joint venture between Denison (90%) and JCU (Canada) Exploration Company Ltd. (10%), with Denison as operator. Effective August 3, 2021, Denison acquired 50% of JCU.

Phoenix FS Highlights

- Base case pre-tax Net Present Value (“NPV”) (8%) of $2.34 billion (100% ownership-basis) is a 150% increase in the base-case pre-tax NPV8% for Phoenix from the 2018 PFS.

- Very robust base-case pre-tax Internal Rate of Return (“IRR”) of 105.9%.

- Base-case after-tax NPV8% of $1.56 billion (100% basis) and IRR of 90.0% – with Denison’s effective 95% interest in the project equating to a base-case after-tax NPV8% of $1.48 billion.

- Base-case pre-tax and after-tax payback period of 10 months – equating to a reduction of 11 months for the pre-tax payback period from the 2018 PFS.

- Production profile has been optimized, based on ISR mine planning efforts evaluating production potential for individual well patterns – resulting in an increase to the planned rate of production by approximately 43% during the first five years of operations.

- Estimated pre-production capital costs of under $420 million (100% basis), yielding an impressive after-tax NPV to initial capital cost ratio in excess of 3.7 to 1.

- Robust economics easily absorb cost-inflation and design changes impacting both operating and capital costs, confirming Phoenix’s position with estimated cash operating and all-in costs expected to be amongst the lowest-cost uranium mines in the world.

- Phoenix FS plans are aligned and costed to meet or exceed environmental criteria expected to be required by the ongoing regulatory approval process.

- Updated mineral resource estimate, reflecting results of 70 drill holes completed in support of ISR de-risking and resource delineation activities, has upgraded 30.9 million pounds U3O8 into Measured mineral resources, and increased the average grade of the Zone A high-grade domain, which is now estimated to contain 56.3 million pounds U3O8 in Measured and Indicated mineral resources, at an average grade of 46.0% U3O8.

- Upgraded 3.4 million pounds U3O8 into Proven mineral reserves, representing the equivalent of 85% of production planned during the first calendar year of operations.

Gryphon Update Highlights

- Scope of Gryphon Update was targeted at the review and update of capital and operating costs – mining and processing plans remaining largely unchanged from the 2018 PFS aside from minor scheduling and construction sequencing optimizations.

- Base case pre-tax NPV (8%) of $1.43 billion (100% basis), is a 148% increase in the base-case pre-tax NPV8% for Gryphon from the 2018 PFS.

- Strong base-case pre-tax IRR of 41.4%.

- Base-case after-tax NPV8% of $864.2 million (100% basis) and IRR of 37.6% – with Denison’s effective 95% interest in the project equating to a base-case after-tax NPV8% of $821.0 million.

- Base-case pre-tax payback period of 20 months, and base-case after-tax payback period of 22 months – equating to a reduction of 17 months for the pre-tax payback period from the 2018 PFS.

- Project remains to be positioned amongst the lowest-cost uranium mines in the world and provides Denison with an additional source of low-cost potential production to deploy significant free cash flows expected from Phoenix.

References & Reports

For more information, see the press release dated June 26, 2023 and the “NI 43-101 Technical Report on the Wheeler River Project, Athabasca Basin, Saskatchewan, Canada” dated August 8, 2023 with an effective date of June 23, 2023.

The technical information has been reviewed and approved by Mr. Chad Sorba, P.Geo., Denison’s Vice President Technical Services & Project Evaluation, a Qualified Person in accordance with the requirements of NI 43-101.

The Phoenix FS and Gryphon Update have been completed in accordance with NI 43-101, Canadian Institute of Mining, Metallurgy and Petroleum (CIM) standards, and best practices, as well as other standards such as the AACE Cost Estimation Standards. Other than as discussed herein and the risks identified in the Company’s Annual Information Form dated March 27, 2023 or subsequent quarterly financial reports filed under the Company’s profile on SEDAR and EDGAR, there are no known legal, political, environmental or other risks that could materially affect the potential development of the mineral resources.

The qualified persons involved in the preparation of the Phoenix FS and Gryphon Update summarized in the press release from which this information was taken, and the related technical report, have followed industry accepted practices for verifying that the data used in the study is suitable for the purposes used. Data verification undertaken by Qualified Persons included review of drill core, review of quality assurance program and quality control measures and data, re-sampling and sample analysis programs, and database verification, as applicable. Validation checks were also performed on data. The independent Qualified Persons for the Phoenix FS, led by Wood’s David Myers P.Eng., have prepared the scientific and technical information on the Phoenix FS and reviewed the information that is summarized in the press release. Site visits by four of the Qualified Persons (Lorne Schwartz and David Myers from Wood, Cliff Revering from SRK and Dan Johnson from WSP, who each attended at Phoenix) was one element of such data verification procedures for the Phoenix FS. The independent Qualified Persons for the Gryphon Update, led by Engcomp’s Gord Graham P.Eng., have prepared the scientific and technical information on the Gryphon Update and reviewed the information that is summarized in the press release. Site visits by two of the qualified persons (Mark Mathieson from SLR at Gryphon and Will McCombe from Hatch at McClean Lake) was one element of the data verification procedures for the Gryphon Update.